It is now a full decade since the financial turmoil that heralded the beginning of the “long depression”.1 On a global scale, the recession that developed in the wake of the collapse of the Wall Street bank Lehman Brothers in autumn 2008 was over after a year.2 However, while the recession technically ended long ago, the world since then has been locked in a phase of development markedly different from that which preceded it. A recent analysis of the United States economy, still the largest in the world, estimated that in the 2008-2015 period there was an average annual 20 percent shortfall in fixed capital investment due to the crisis. The negative impact on GDP averaged 10 percent.3

It is in this context that figures such as Larry Summers, former US president Bill Clinton’s treasury secretary, talk of entering an “age of secular stagnation”, while Christine Lagarde, head of the International Monetary Fund, speaks of “a new mediocre” for the capitalist system.4 Nonetheless, many commentators saw 2018 as the year in which the economy would finally lift itself out of this malaise. The Financial Times’s Martin Wolf described a world economy “humming” with growth, while Gavyn Davies welcomed “tentative signs that secular stagnation is beginning to fade”.5

The argument here is that this optimism is likely to be misplaced. Back in 2010, I wrote that the developing recovery, then in its initial stages, would be “weak, fragile and uncertain”.6 The weakness was a result of the failure of the recession of 2008-9 to destroy or devalue sufficient unprofitable capital, or deleverage enough debt, to ensure a strong rebound in profitability. The fragility came, above all, from the bloated financial system, which threatened to generalise any new sign of crisis. The uncertainty was a product of state interventions that helped put a floor under the crisis without resolving the fundamental problems that caused it.

This prognosis remains a useful guide to the development of the world economy since the recession, and those three aspects of the recovery will frame the analysis here.

Profitability and the weakness of recovery

Consider first the weakness of the recovery. No region of the world is experiencing consistent growth at the rate enjoyed prior to 2008—even the more successful large economies of the Global South, some of which experienced rapid growth prior to the crisis, have had to lower their expectations.7 For the established economies of the Global North, average growth rates of over three percent, as experienced in the 1960-80 period, now seem like a receding dream. Estimates of growth in 2016 put the US figure at 1.6 percent, the euro area at 1.8 percent and Japan at 1.1 percent.8

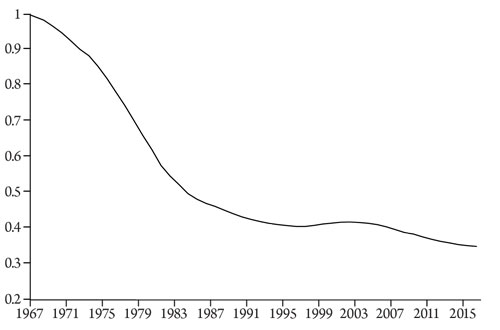

The backdrop to this weakness in the recovery is an underlying problem of a persistently low rate of profit across the core of the capitalist system. A long decline in profitability took place in the period from 1950-82, and since the early 1980s the capitalist system has remained trapped in a period of relatively low profitability. According to one of the Marxist economist Andrew Kliman’s estimates, the rate of profit for the US corporate sector fell from over 20 percent in 1950 to below 7 percent in 1982—and has oscillated around that level since (figure 1).9 This decline is echoed in the movement of the global average rate of profit (figure 2).

Figure 1: Profit rates in the US corporate sector (percentage, inflation adjusted)

Source: Adapted from Kliman, 2011.

Occasionally, this decline in profitability does impinge on the thinking of mainstream economists. So a column in the Financial Times in 2010 lamented the fall in the “return on investment” from an estimated 15 percent in the post-war period, through to 10 percent by the end of the 1980s. By the late 1990s, the author suggests, the return was only “5 percent and few would put money at risk for that reward”.10

Figure 2: Estimates of the global rate of profit (percentage)

Source: Adapted from Maito, 2014.

However, understanding why this has happened requires us to return to an aspect of Karl Marx’s explanation of crisis, which he develops in Capital, especially in the third volume. Marx’s argument is based on the premise that the source of new value under capitalism is the “living labour” of workers engaged in the process of production of goods and services. Indeed, in his analysis the entirety of surplus value, the source of profit, available to capital is the gap between the amount of value created by living labour in the working day and the remuneration they receive. There is no necessary relationship between the two: the capitalist who employs a worker simply has to advance to them the established amount of value, in the form of a wage, to get them back to work the next day. Provided this is less than the value created over the course of the working day, surplus value can be appropriated by the capitalist.11

Marx goes on to argue that the capitalist invests not simply in living labour, but also, increasingly, in “dead labour”, this being the plant and equipment used in the process of production. Dead labour represents neither a loss nor a gain for the capitalist. It is itself the product of past living labour and so has a value, but, as it is used up in production, its value passes into the finished product and may, if all goes well, be recouped by the capitalist.12 If investment in dead labour outpaces the investment in living labour, there will be a system-wide tendency for profit rates to decline, because a greater value of investment is mobilised to capture a more slowly increasing mass of surplus value.

Figure 3: Estimates for the US rate of accumulation (net non-residential investment/historical cost of non-residential fixed assets), 1967=1

Source: Bureau of Economic Analysis (BEA) data.

Furthermore, even though investment in dead labour might have the long-term impact of reducing profitability, it is nonetheless an unavoidable feature of capitalist competition because such investment is required to reduce the cost of individual commodities. Capitalists are impelled to accumulate capital, and in particular dead labour, because to fail to do so means to be left behind in the battle of competition. One only has to imagine for a moment a car manufacturer using the techniques and machinery of the 1960s and attempting to match their rivals on the global market to see why this is the case.

The process of accumulation is itself funded out of past profits (or by credit that will be repaid out of future profits) and so the rate of profit places limits on the rate of accumulation—and the long-term decline in profitability helps to explain the slowdown in both accumulation and productivity growth in recent years (see figure 3).13

When the rate of profit is high, accumulation can proceed more rapidly, as in the 1950s and 1960s, leading to a relatively rapid decline in profitability; in other words the very dynamism of capitalism in such phases begins to undermine future accumulation. As Marx writes:

A fall in the profit rate, and accelerated accumulation, are simply different expressions of the same process, in so far as both express the development of productivity. Accumulation in turn accelerates the fall in the profit rate… In view of the fact that the…rate of profit…is the spur to capitalist production…a fall in this rate…appears as a threat to the development of the capitalist production process; it promotes overproduction, speculation and crisis… The important thing in [capitalist thinkers’] horror at the falling rate of profit is the feeling that the capitalist mode of production comes up against a barrier to the development of the productive forces…this characteristic barrier…testifies to the restrictiveness and the solely historical and transitory character of the capitalist mode of production.14

The decline in profitability is counteracted by various factors noted by Marx. The most important of these are increases to the rate of exploitation of living labour and declining prices of dead labour, which curb the growing costs of investment relative to profit. Various authors have argued that the first factor has featured throughout the neoliberal period and has helped partially to restore profitability, or at least slow or halt its decline.15 However, there are limits to the extent to which work can be intensified and wages can be reduced—mathematical limits, but before those are reached, physical and social limits as workers rebel against their conditions.

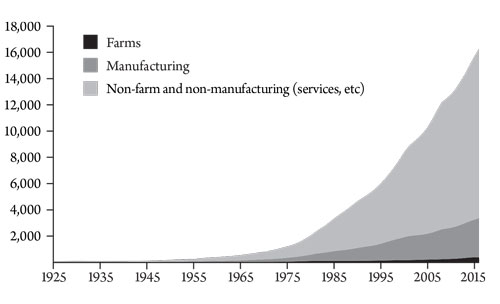

The decline in the cost of dead labour is a more feasible challenge to the whole notion of a downward trajectory for profit rates. However, the falling price of dead labour during the normal functioning of capitalism is not necessarily beneficial to individual capitalists. The capitalist who has already invested in expensive machinery at the old price, and who expects to recoup the value of this machinery over years or even decades, will suffer a loss of profits if their rivals obtain the same machinery at a new, lower price, reducing the price of the output. Furthermore, even if the fall in prices of machinery takes place in such a way that the average profitability is raised, the presence of higher profits will tend simply to fuel a new round of investment in dead labour. While most capitalists can take advantage of “capital saving” investments, the biggest and most successful will also generally seek to make use of the most expensive “labour saving” investments, which are out of reach of their competitors, spurring a wave of investment that will subsequently lead to a fall in profitability across the system as a whole.16 In practice, whatever the disputes about the tendency at the level of theory, empirically the value of investment in dead labour, particularly the fixed capital contained in plant and equipment, has tended to rise over the past century rather than fall (see figure 4).

Figure 4: Historic cost of stock of capital for the US private sector ($billions)

Source: BEA data.

It tends to be only in moments of crisis that the value of dead labour is catastrophically and suddenly reduced across the whole system—through firm failure and the dumping on the market of excess goods, the destruction of unprofitable units of capital and the deleveraging of debts that weighed down the system—creating the context in which profitability can be restored. This was what happened between 1930 and 1945, through slump and war, paving the way for the long boom that began in the wake of the Second World War.17

But, as many Marxist and non-Marxist authors have pointed out, capitalist crisis cannot be conceived simply in terms of the movement of profit rates. For some this suggests a multi-causal accounts of crisis.18 However, Alex Callinicos, in a recent exploration of Capital, usefully proposes that the different factors in capitalist crisis can be separated into “enabling”, “conditioning” and “causal” categories. The first category includes the formal possibility of breakdown inherent in the purchase and sale of commodities, because the sale of one commodity does not necessarily entail that the money will be used to purchase another. It also includes the possibility of a disequilibrium developing between different “departments” of the economy, particularly those producing consumption goods and those producing means of production. Conditioning factors include movements of wages and shifts in the level of employment, and the pattern of turnover of large-scale investment in fixed capital. But the causal factors, Callinicos argues, are the movement of profit rates and the related financial cycles identified by Marx in volume three of Capital, which will be discussed below.19 This approach allows a general account of the causes of crisis to emerge without neglecting the other features that shape how the crisis develops.

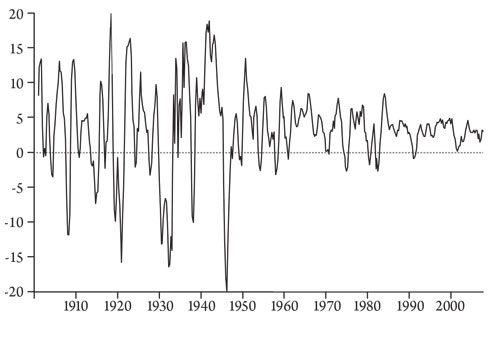

Figure 5: US GNP growth 1900-2007 (percentage)

Source: Adapted from Tymoigne, 2008.

In this account, crisis is the process through which, as Marx puts it, the “momentary suspension of all labour and annihilation of a great part of the capital violently lead [capitalism] back to the point where it is enabled [to go on] fully employing its productive powers without committing suicide”.20 Yet the capitalist system does not experience crisis in the same manner throughout its history. Another long-term process identified by Marx, that of the concentration and centralisation of capital, leading to creation of a world of giant capitalist enterprises, changes the way these tendencies play out.21 In particular, as the units of capital swell to enormous size, and interlock with the state and financial system, the problem today known as “too big to fail” comes to the fore.22 States, which came to play a major role within the capitalist economy through the 20th century, are forced to decide whether to allow the painful process of crisis to take hold, in the hope that the resulting “creative destruction” will restore the capitalist system to health,23 or whether to bail out and support failing firms in order to avoid a catastrophic slump as some of these corporate behemoths fail. The tendency of big firms to engage intensively and directly with financial markets exacerbates the problem, as the failure of one firm can easily affect other, seemingly unrelated ones. In the face of these dilemmas, the post-war crises of capitalism have not seen a sufficiently big clear-out of unprofitable units of capital to restore profit rates to the heights seen in the two decades following the Second World War.24 The whole pattern of boom and bust was somewhat tempered but at the price of allowing the contradictions of capital to gestate and fester over the long term. It was, in the run-up to the crisis, a commonplace to talk of the period from the early 1980s as a “great moderation”, in which economic indicators such as GDP growth had become less volatile in countries such as the US (in many countries of the Global South things look quite different). However, when viewed from a longer historical perspective, it becomes clear that the great moderation has to be seen as an intensification of an earlier moderation that took place at the end of the Second World War (see figure 5).

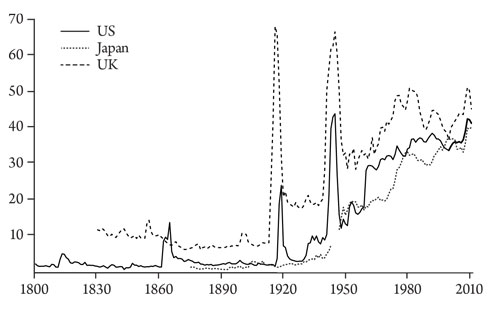

Figure 6: State expenditure as a percentage of GDP

Source: Data from Mauro, Romeu, Binder and Zaman, 2013.

The world of big capital and big states that emerged from the war resulted in fewer sharp contractions in the economy, but also less explosive growth during booms. In the decades that followed the war, high levels of arms spending and other forms of “waste” expenditure, which did not feed into successive rounds of accumulation, could also act as a “leak” out of the system, helping to prolong the boom by slowing the rise in the organic composition of capital.25 When this period gave way to crisis in the 1970s, the result was a reorganisation of capitalism, with some destruction of unprofitable industries, combined with measures to contain workers’ aspirations in line with the new reality of low profitability. The period that opened up, marked by a shift to a neoliberal policy regime in the advanced economies of the Global North,26 saw little decline in the scale of state involvement in the economy (figure 6). This was combined with the continued centralisation of capital, for instance through waves of mergers and acquisitions in the late 1990s and again in the run-up to the crisis. It was in this context that the crisis tendencies of capitalism increasingly manifested themselves as a long, secular decline in profitability after 1947, in which profit rates continued to trend downwards over multiple economic cycles before stabilising at low levels. The long-term trend was superimposed on the short-term fluctuations of profitability through the cycle. A full-scale crisis was repeatedly deferred, largely through state intervention, only to return in new forms (the changing historical forms of intervention are discussed in more detail below).

By preventing the system ridding itself of its deepening problems, the transformations of capitalism that took place in the second half of the 20th century created powerful tendencies towards long-term stagnation. But that does not mean that the system has simply stagnated. The tendency towards stagnation coexists with the dynamism produced as those presiding over the system competitively reorganise their capital and seek new areas of the globe into which to expand, the Chinese boom being the most clear example. Yet without understanding the stagnationary tendencies rooted in low profitability it is impossible to grasp why the current crisis has been so deep and prolonged.

Weakness in the Global South

In the aftermath of the crisis it was widely believed that the weakness in the advanced economies could, in part, be counteracted by the strength of the big economies of the Global South. As John McFarlane, chair of Barclays Bank, put it: “The past years evidenced a two-tier world, with emerging markets and oil-rich countries the darlings and the developed world still in recovery from the global financial crisis”.27 Hope was focused, in particular, on China, now the world’s second biggest economy.

In fact, not only did China fail fully to escape the crisis but it has also become a source of instability. China’s pre-crisis growth was based on intense exploitation, extraordinary levels of investment—sometimes running at over 45 percent of GDP28—and production directed towards export markets. As those markets began to dry up during the global recession, the Chinese state responded by using credit to keep the investment frenzy going. Total debt rose from 160 percent of GDP in 2008 to reach about 260 percent. This has been accompanied by the growth of financial institutions: today China has the largest banking system in the world—bigger even than that of the Eurozone—with substantial lending also now taking place outside the traditional banking sector. The Chinese response to the crisis was captured well by Martin Wolf in the Financial Times:

In response to the 2008 financial crisis, China promoted a huge rise in debt-fuelled investment to offset the weakening in external demand. But underlying growth in the economy was slowing. As a result, the “incremental capital output ratio”—the amount of capital needed to generate additional income—has roughly doubled since the early 2000s… At the margin, much of this investment is likely to be lossmaking. If so, the debt associated with it will also be unsound.29

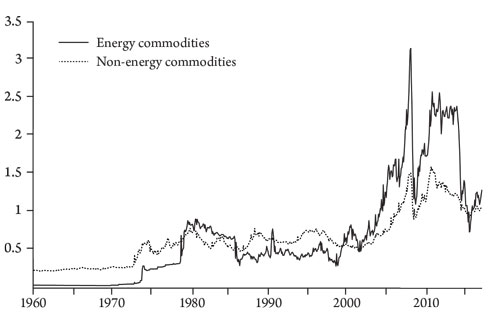

Figure 7: Commodity prices, current $ (2016 = 1)

Source: World Bank data.

This is simply a description of what Marx would call a crisis of “overaccumulation”. In other words, too much capital chasing a limited pool of profit and driving down profitability.30 The response, allowing credit growth to drive the economy forward, is not confined to China. Credit has grown across many economies in the Global South. In allowing this to happen, governments and central bankers in these countries are simply learning the lessons of the more established capitalist powers, for this was precisely the path taken by the US government and the US Federal Reserve in the wake of the early 2000s recession and the 9/11 attacks. They slashed interest rates and allowed a property bubble to develop, a bubble that eventually led to the credit crunch of 2007, centred on “sub-prime” mortgages.31 There are though, as that example demonstrates, limits to what credit can achieve. The IMF has recently warned that the Chinese economy now needs three times as much credit as at the time of the crisis in order to achieve the same amount of growth. It concluded: “International experience suggests that China’s credit growth is on a dangerous trajectory, with increasing risks of a disruptive adjustment and/or a marked growth slowdown”.32

The deceleration in China has increased pressure on other economies. Countries such as Brazil have, in recent years, reoriented their economies to supply the Chinese boom with raw materials. In Brazil this meant a five-fold increase in the export of primary goods from 1999 to 2009, with iron and soya exports to China central to the growth.33 More generally, Chinese deceleration accompanied by sluggish global growth has ended what was known as the “commodities supercycle”—a generalised increase in commodity prices that helped fuel growth in the big exporters of the Global South (see figure 7). The sudden shock to Brazil’s economy as demand faltered and prices fell helped precipitate the worst recession in the country’s history—with two full years of contraction. The Argentinian, Russian and Nigerian economies also shrank in 2016, while Turkey’s growth slowed from 6.1 to 2.9 percent and that of South Africa dropped from 1.3 to 0.3 percent.34

Financial fragility

The second feature of the recovery identified above is its fragility. This is a product of the expansion of the global financial system over the past 40 years. This growth is also, to a large extent, a response to the low levels of profitability in the goods and services creating areas of the economy. Finance is not simply a parasitic outgrowth of capital. Rather, as capital develops, the mobilisation, as interest-bearing capital, of money that cannot find a ready outlet in the hands of particular capitalists helps to drive the system forward. However, beyond a certain limit, finance contributes to the destabilisation of capitalism.35 Marx captures both the dynamic and crisis-inducing elements in volume three of Capital:

Through the banking system, the distribution of capital is removed from the hands of the private capitalists and usurers and becomes a special business, a social function. Banking and credit, however, thereby also become the most powerful means for driving capitalist production beyond its own barriers and one of the most effective vehicles for crises and swindling.36

Finance drives capitalism beyond its limits by utilising any idle reserves of money and setting them in motion. In the form of interest-bearing capital, value can move between spheres of the economy or across borders with greater fluidity than ever before. But ultimately credit has to be repaid—and there is no guarantee that production will take place or that a profit will be obtained to a sufficient degree to achieve this. With the frenzy of accumulation, chains of credit and debt can form as banks and other financial institutions borrow in order to lend. Over recent decades many non-financial firms have also become involved in lending—for instance General Electric was, in the run up to the crisis, gaining around half its profit from its financial operations.37 The growth of finance rests on the assumption that accumulation and profit-making will continue, and that there will not be a general crisis in which debts are called in all at once. Marx writes:

The chain of payment obligations at specific dates is broken in a hundred places, and this is still further intensified by an accompanying breakdown of the credit system… All this therefore leads to violent and acute crises, sudden forcible devaluations, an actual stagnation and disruption in the reproduction process, and hence to an actual decline in reproduction.38

There is another aspect to the growth of finance. Marx comments that interest-bearing capital is “the mother of every insane form”.39 Interest-bearing capital seems to expand magically as it receives interest payments; from the perspective of the money lender, it is as if living labour does not even have to be harnessed. Owning capital seemingly gives the capitalist an automatic right to grab a portion of surplus-value. But once this happens, any stream of income can be treated in a similar way. This is the case, for instance, with bonds issued by central banks or by companies, which pay the holder a fixed sum at regular intervals. Shares traded on the stock market differ from bonds in that they represent ownership of a firm and pay a dividend to holders, but, again, they can be treated as an asset entitling the holder to an income stream. These paper claims over wealth are examples of what Marx calls “fictitious capital”.

Fictitious capital has three characteristics in Marx’s account. First, as already noted, it represents a claim over a stream of income that can be treated like interest. Second, when these claims are issued against real capital, the capital appears to be doubled. For example, if I buy a share in a company, and the company uses the money to invest, the money invested in machinery and labour power is “real” capital. The piece of paper I hold entitles me to a claim over some of the resulting profits but it is itself merely a fictitious capital. The capital does not exist twice over. Third, fictitious capital trades according to its own laws of motion.40 Because of this, it is an ideal vehicle for speculation. It creates the possibility of bubbles emerging as investors drive up the price of such assets based on expectations of future income or simply gamble on the price continuing to rise. Because capitalism, in reality, still relies on pumping surplus value out of workers, markets in fictitious capital can lose touch with the underlying process of value production.

This is all the more likely in periods of low profitability for the “real” economy. Marx writes: “If the rate of profit falls…we have swindling and general promotion of swindling, through desperate attempts in the way of new methods of production, new capital investments and new adventures, to secure some kind of extra profit”.41 Markets in fictitious capital have indeed grown and diversified enormously in recent decades, becoming increasingly detached from production, even as they have drawn in companies that engage in production. Three important aspects are “securitisation”, the growth in markets in “derivatives” and the rise of the “shadow banking system”.

One example of securitisation is the issue of collateralised debt obligations (CDOs) by banks, which began to take off in the late 1980s and became increasingly prevalent in the run-up to the crisis. CDOs are created from portfolios of debt pooled together by banks, the ownership of which is transferred to a “special purpose vehicle” (SPV), a temporary company formed for the purpose. This SPV then issues bonds, which are sold on to investors. The process is dubbed securitisation because bonds are an example of a security (a tradable financial asset). Essentially, the loan repayments act as a stream of income to the ultimate investors, while, for the bank, the debt is sold on, recouping the cash and allowing it to issue more loans. There are, in addition, lucrative fees for those overseeing the process. Prior to 2007, the most risky “tranches” of the bonds issued by SPVs, and hence the most attractive to speculators, often included large numbers of subprime mortgages. The amount of CDOs issued globally rose from $68 billion in 2000 to $521 billion in 2006.42 As a recent European parliament report put it: “Securitisation amplified the crisis by contributing to lengthening the intermediation chain, by creating conditions for incentives and interests between participants in the securitisation chain to be misaligned, by increasing the reliance on mathematical models and on external risk assessments and, finally, by increasing both individual and systemic bank risks”.43

While CDO markets have not recovered to anything like pre-crisis levels, there has recently been a notable rise in the issue of “collateralised loan obligations” (CLOs), particularly those associated with commercial loans, with $100 billion dollars’ worth issued last year, the second highest figure on record. This recent growth is not simply driven by banks—it reflects the “search for yield” among investors faced with artificially low interest rates, a point developed below.44

Accompanying securitisation there has been an explosive growth in derivatives. These consist of assets that change in value depending on what happens to some underlying asset. For instance, a “credit default swap” compensates the holder in the event of a specific debt defaulting, in return for which they pay a small regular fee to the counterparty. This can be a useful form of insurance, “hedging” against a risk. However, derivatives can be bought and sold for purely speculative reasons—by people who are not exposed to the underlying risk and simply wish to gamble on whether or not something will happen.45 In the run-up to the crisis the derivatives market was dominated by interest rate contracts (which pay out as rates move), followed by CDSs.46 Again, the market in derivatives has not recovered to peak levels seen immediately prior to the collapse of Lehman Brothers in 2008, but nor has the growth been entirely reversed. In the first half of 2017, the gross market value of “over-the-counter” derivatives (the money required to replace them at market prices) still stood at $12,690 billion, roughly where it was in early 2007.47

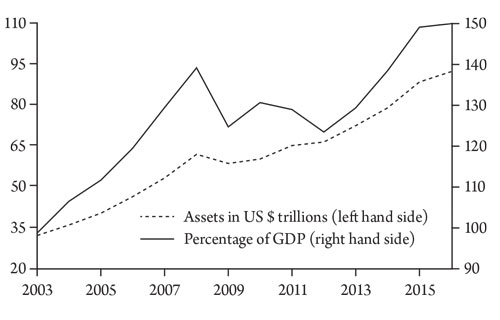

Along with these trends, recent decades have seen the rise of the shadow banking system—financial institutions that engage in borrowing and lending but are not traditional banks, and not regulated as such. Important players in this sector include hedge funds, money market funds, real estate investment trusts, broker dealers and structured finance vehicles. By the time of the crisis shadow banking was, measured by financial assets, probably larger than the traditional banking sector in the advanced economies of the Global North. While the shadow banking sector was hit by the crisis, it resumed its expansion at close to pre-crisis rates from the end of 2011, and by 2016 its assets were considerably greater than when the crisis erupted (figure 8).

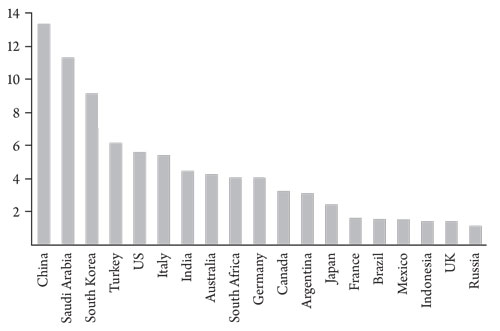

Figure 8: Shadow banking: estimates of “other financial intermediaries” (based on 21 jurisdictions and euro area

Source: Adapted from FSB, 2017.

Some of the growth of the financial system since the 1980s was bound up with, or ultimately led to, real accumulation, but much of it simply generated a series of bubbles. These include: the dot-com bubble in high-tech firms on the stock market of the 1990s; the property bubbles experienced in the UK, Spain and Ireland, and today in China; and the commodities super cycle noted above. Underlying them all, a mega-bubble of credit developed. Wolf went so far as to describe the developing system, which he said had become “bigger and riskier”, as a “financial doomsday machine”.48 The expansion of credit generally helped both to conceal and to defer capitalism’s problems in the period from the early 1980s, as part of a system sometimes dubbed “privatised Keynesianism”,49 but only at the expense of creating a grotesquely oversized financial system that would ultimately explode into crisis. The fact that the long depression began in the field of finance led many commentators to identify it as simply a financial crisis. This mistakes the immediate trigger of the crisis and its indirect cause. The context of subdued profitability is crucial to understanding what happened.50

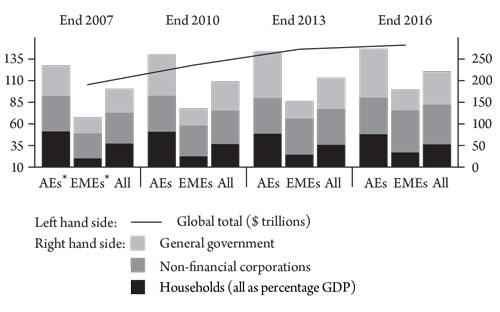

Figure 9: Global debt since the crisis

Source: Adapted from BIS, 2017. *AEs = “advanced economies”, EMEs = “emerging market economies”.

Some believed that the crisis of 2008-9 would allow the economy to be rebalanced away from its dependence of finance but this has not occurred. Instead, at best, credit expansion has stabilised in the most advanced economies. However, there has been significant credit growth in the Global South (see figure 9). The enduring scale of the financial system ensures that each new wave of panic gets transmitted globally and amplified. For instance, there was a big fall in stock markets early in 2016 in response to the December 2015 decision to raise US interest rates; in spring 2016 there was a rout of shares in European banks, caught between the impact of negative interest rates and worries about the quality of the loans on their books. From summer 2015 through to spring 2016 there was turbulence in Chinese stock markets, now seen as central enough to global capitalism to spark huge falls on US exchanges.51 Another round of turbulence in February 2018 again reflected fears of tightening monetary policy in the US and elsewhere.

Political fragility

To this already fragile edifice should be added a growing source of instability since the recession, namely the political turmoil unleashed by the recession itself. Even prior to the crisis, the consensus between centre-left and centre-right parties around neoliberal policies had begun to lead to a questioning of mainstream politics as a whole, with voters polarising towards both radical left and radical right alternatives. It is now clear that the dominant response to the crisis from the ruling class—to protect the system at the expense of those living under it, in particular their attempts to socialise the crisis through austerity—has accelerated that process.

One consequence has been the reluctance of voters to follow in sheep-like fashion the prerogatives handed down by the establishment. Events such as Brexit, which was opposed by every major Westminster party, almost all the major banks and corporations, and most of the institutions of global and European capitalism, represent a major challenge for the ruling class. The volatility is even apparent in Germany, supposedly the stable heartland of European capitalism. In the 2017 elections in Germany the Social Democratic Party (SPD) and Christian Democratic Union (CDU), the two major parties, saw their vote fall to just over half of the total, down from three-quarters in 1990. The far-right Alternative Für Deutschland made a major breakthrough.

Even more troubling in terms of global stability has been the ascension of Donald Trump to the presidency of what remains the greatest economic and political power on Earth. The threat posed by Trump is threefold. First, the potential to further toxify global geopolitics—as represented by the interventions in Syria and the growing tensions with North Korea. “War”, Wolf argued in his generally upbeat assessment of the global economy in January 2018, “is the biggest political risk to the economy”.52 Second, Trump significantly undermines the possibility of global cooperation between the major Western powers. Again, Wolf accurately captured the concerns of large sections of the ruling class:

What…has happened to global cooperation? Here…we saw significant developments [in 2017]. One was the decision of Mr Trump to pull out of the Trans-Pacific Partnership, in which US allies, notably Japan, had invested so much, and to renegotiate the North American Free Trade Agreement. Another was the administration’s decision to pull out of the Paris climate agreement… These political developments have fractured the west as an ideologically coherent entity. Close cooperation among the high-income countries was largely a creation of US will and power. The centre of that power currently repudiates the values and perception of interests that underpinned this idea. That changes just about everything.53

This does not necessarily mean the end of the period of globalisation, as the latter is a multidimensional process, encompassing complex global value chains in which production by multinational companies extends across borders, along with flows of finance, which, as noted above, do not seem to have retreated. Yet the historic commitment of post-war US governments to extend global free trade through institutions such as the World Trade Organisation and, more recently, regional trade deals, seems to have faltered.54 The decision of the Trump administration to impose tariffs on imports of solar panels and washing machines in January was one sign of the new mood in the White House. Notably the tariffs do not just hit China—the biggest importers of washing machines into the US in 2017 were Vietnam, Thailand and South Korea; the biggest importers of solar panels were Malaysia, South Korea and Vietnam. This was followed by Trump’s announcement of a 25 percent tariff on US steel imports, and 10 percent on aluminium, leading to threats of retaliation from other major economies such as the EU and China, and the resignation of his top economic advisor Gary Cohn.

Then there is the question of the huge tax cuts introduced by Trump. The immediate effect of these was to send stock markets into the stratosphere, but as Lagarde argues: “While the US tax reforms certainly will have positive effects in the short term, for the US and other countries around, it might also lead to serious risks… That has an impact on financial vulnerability, particularly given the high asset prices that we see around the world, and the easy financing that is available”.55

Uncertainty

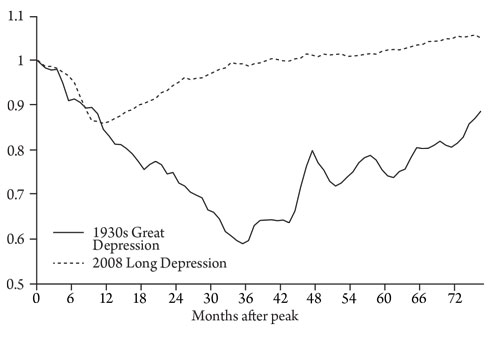

The third aspect of the post-recession recovery is its uncertainty due to its reliance on state support. When the crisis broke it appeared to be an event on the scale of the Great Depression of the 1930s, and indeed, for the first year after the collapse of Lehman Brothers, the trajectory seemed unsettlingly similar. However, a number of state interventions helped drag the global economy out of its malaise (figure 10).

The most visible signs of state intervention were the banking bailouts orchestrated in a number of countries. However, though these undertakings were enormous in scale, the amount actually spent, and in particular the net cost to the state, was often relatively small.56 More significant were the stimulus packages enacted by several governments (figure 11). One important consequence of this dramatic intervention of the state—along with falling tax revenues and increasing strains on social spending—was to place unbearable pressure on weaker economies that had been exposed to the financial implosion, especially in Southern and Eastern Europe.57 This led the financial crisis and recession to morph into the European sovereign debt crisis that began in late 2009, the effects of which continue to be felt. The Italian banking sector has appeared especially frail of late—with, according to ECB data, €224.2 billion in non-performing loans outstanding.58

Figure 10: World industrial production in two crises (pre-crisis peak = 1)

Source: Data from CPB, 2018; Wall, 1936.

Figure 11: Economic stimulus as percentage of GDP

Source: EC-IILS, 2011.

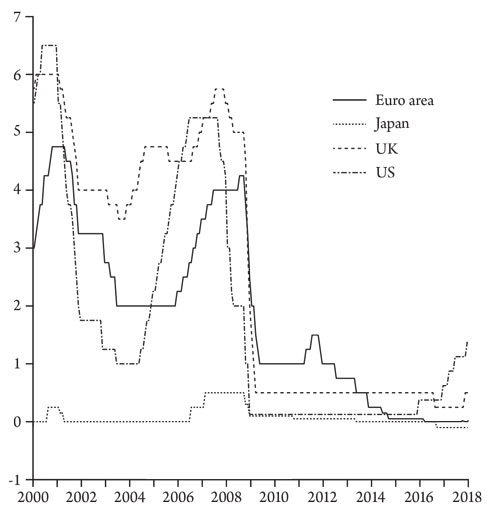

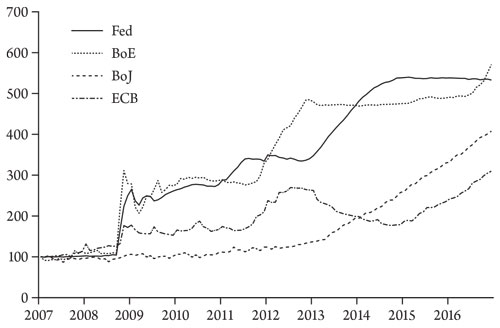

In some ways the most important measures to mitigate the impact of the crisis were taken by central banks.59 Interest rates were driven down to ultralow—or even negative—levels across the advanced economies (see figure 12). Moreover, many central banks—including the Fed, the Bank of England and the European Central Bank—launched quantitative easing programmes or, in the case of the Bank of Japan, expanded an existing programme. Quantitative easing involves central banks electronically creating money and using it to purchase assets from banks and other financial institutions, in particular acquiring government bonds. Doing so has two effects. First, it floods the banking system with liquidity, supposedly encouraging lending. Second, it drives up the price of bonds. Bonds pay a fixed income at regular intervals, so, if they increase in price, their “yield”, the return on the investment relative to the price, tends to fall. Lower yields mean lower borrowing costs. Ultimately, quantitative easing must be “unwound”, with the bonds sold off and the money (electronically) recouped destroyed once more.

Figure 12: Policy rates of interest

Source: BIS data.

Through these mechanisms, capitalism was placed on a life support mechanism—but one that took a distinctively financialised form (see figure 13, which indicates the extent to which central banks have mopped up bonds during their quantitative easing programmes). The measures ostensibly aimed to ensure a stream of credit to corporations, boosting production. But, in conditions of subdued profitability, this failed to transpire. Rapid accumulation takes place in conditions in which investors believe that production is going to be profitable. Instead money was either squirrelled away by the banks or streamed into financial investments, often high-yielding, risky investments. A report in the Financial Times captures well how the financialised bailout has helped to feed further bubbles though a “search for yield”:

Quantitative easing…left investors with cash that they had little choice but to put into risky assets… The havens were traditional stores of value that took on the acronym SWAG: silver, wine, art and gold. By 2012, SWAG assets had formed a bubble. But it deflated as inflation fears receded and confidence in governments returned. Bricks and mortar offered another haven—particularly for those nervous that their countries might not always tolerate their wealth. Several housing markets have rallied despite lacklustre economic growth. In particular, London, a classic haven for foreign owners, and Vancouver, a favourite of the Chinese community, saw dramatic gains… The classic bubble appears to be in cryptocurrencies, led by bitcoin. The technology is new, exciting and potentially revolutionary. But the rise in a currency that has no intrinsic value and no government recognition is still breathtaking.60

Figure 13: The evolution of central bank balance sheets (January 2007 = 100)

Source: Credit Suisse, 2017.

Many of the fears for the recovery in 2018 surround the question of what happens when this life support system is shut down. The US Fed under its outgoing chair, Janet Yellen, took a cautious approach, gradually tapering off quantitative easing, and raising interest rates in small, incremental steps, forewarning markets at each stage. Things are likely to be much harder for her successor, Jerome Powell, as fears grow about the level of exuberance of US financial markets and the danger of inflation beginning to pick up. As the Guardian’s Larry Elliott writes: “Now there is concern that the Fed is a bit behind the curve and will be forced into tougher action than the markets had hitherto been expecting”. As Elliott adds, the action taken in 2008-9 means central banks have “created a huge moral hazard problem for themselves”, with reckless investors assuming that any major downturn will be met with further interest rate cuts and more quantitative easing.61

Not only has the financialised bailout fuelled speculation—and, incidentally, inflated the price of the assets of the rich—it has also further deferred any resolution to the underlying crisis. Elliott points to the level of dependence on debt, rising inequality and low levels of investment—but these are rooted in the more foundational issue of low profitability. One way this manifests itself is through the proliferation of “zombie firms”, companies that ought not to survive in a competitive market, but which are able to lumber forward without making significant profits or investing. As the authors of a recent OECD working paper argue:

In a well-functioning market economy, the creative-destruction process compels poorly performing firms to improve their efficiency or exit the market. However, there are signs…that this process may be slowing down and a number of factors suggests that there may be a policy dimension to this problem. These include structural policy weakness (e.g. inefficient insolvency regimes), bank forbearance, loose monetary policy and impaired banking systems and the persistence of crisis-induced SME [small and medium enterprise] support.62

It adds that zombie firms are likely to be older and larger firms, suggesting that this may be because these are the very firms likely to benefit from state support. The paper estimates that 7.5 percent of capital in the UK is invested in zombie companies, with the figure rising as high as 19 percent in Italy.63

Similarly a report by the Bank for International Settlements argues:

Weaker investment in recent years has coincided with a slowdown in productivity growth. Since 2007, productivity growth has slowed… One potential factor behind this decline is a persistent misallocation of capital and labour, as reflected by the growing share of unprofitable firms. Indeed, the share of zombie firms—whose interest expenses exceed earnings before interest and taxes—has increased significantly despite unusually low levels of interest rates.64

An accompanying graph shows the share of zombie companies across the major economies rising from below 6 percent in 2007 to over 10 percent by 2015.65

The long-term effect of a clear-out of zombie companies may be to boost profitability, investment, productivity and, ultimately, growth, but the danger is that, in the short term, it will pull the economy back down into a state of slump. According to a leading analyst at Bank of America:

Monetary support in Europe over the last five years has allowed companies with weak profitability to continue to refinance their debt and stave off defaults… This supports the point that our economists have been making: that the ECB will likely be very slow and patient in removing their extraordinary stimulus over the next year and a half.66

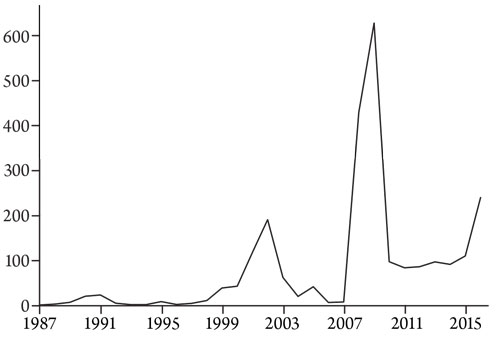

Figure 14: Global corporate defaults (outstanding debt $ billion)

Source: Data from S&P, 2017.

There is already evidence that the modest increase in interest rates and the withdrawal of quantitative easing are having an impact. Globally, corporate defaults reached levels not seen since 2008 in 2016, dominated by defaults of US firms—particularly those in the energy sectors, hit by falling prices (see figure 14).67 In the long run these kinds of processes may pave the way for a new cycle of rapid accumulation and frenzied growth. Yet there is a great deal more disruption and turmoil to come before we reach that point, accompanied by more pain for those who live and labour under the system.

Conclusion

The recession of 2008-9 was a long-deferred crisis for the system, one prepared by a period of subdued profitability, by dysfunctional patterns of financialisation and by the actions of states. The fact that it was not allowed to become a slump on the scale of the 1930s has given us instead a long depression—a prolonged period of relatively sluggish and tentative growth.

The current period sees the opening up of a new stage in this process. For many commentators this is, after many false starts, the beginning of the end of the crisis. Yet other voices have dissented from this optimism. Summers, whose revival of the notion of secular stagnation was noted above, went further in February, warning: “In the next few years a recession will come and we will in a sense have already shot the monetary and fiscal policy cannons. That suggests the next recession might be more protracted”.68

As our rulers begin to withdraw their support for capital they are likely to find that the underlying weaknesses of their system, which have not yet been resolved, come once more to the fore. This, then, is a perilous moment for global capitalism and those seeking to preside over it. Equally it is a moment where those of us who are hostile to that system must redouble our efforts to challenge it.

Joseph Choonara teaches at King’s College London. He is the author of A Reader’s Guide to Marx’s Capital (Bookmarks, 2017) and Unravelling Capitalism: A Guide to Marxist Political Economy (2nd edition: Bookmarks, 2017).

Notes

1 This is the apt term applied to the current prolonged period of crisis and sluggish growth by Michael Roberts in his recent book—Roberts, 2016.

2 There is no universally accepted definition for a global recession. Before 2009, economists often informally referred to a period in which annual global growth rates fell below 2.5 percent or 3 percent as a global recession. After 2009, the International Monetary Fund defined a global recession as a period in which growth was negative for the world economy—something that occurred in 1975, 1982, 1991 and, to a far more devastating degree, in 2009—see IMF, 2009.

3 See Bullard, Silvia and Iqbal, 2017.

4 Summers, 2016; Lagarde, 2014.

5 Wolf, 2018a; Davies, 2018.

6 Choonara, 2010.

7 Sharma, 2017.

8 Bhalla, 2002, p16, table 2.1; World Bank, 2017, p4, table 1.1.

9 I am using the inflation-adjusted corporate sector estimates, with the historic cost of fixed capital as the denominator—see Kliman, 2011, p84. For another estimate, see Shaikh, 2016, p66.

10 Wien, 2010.

11 Those unfamiliar with Marxist economics can consult any of: Choonara, 2017; Callinicos, 1996, pp122-159; Harman, 1995; Choonara, 2013; Fine and Saad-Filho, 2016.

12 In fact things are a little more complicated, as fixed capital in particular often falls in value in the process of capitalist competition as described below. For this and the more general argument about profit rates, see Choonara, 2017, pp64-72.

13 On the connection between profitability and investment, see also Roberts, 2017.

14 Marx, 1991, pp349-350.

15 See for instance Carchedi, 2011, Roberts, 2016, pp21-22, and Shaikh, 2016, pp59-61, 730-732. For an alternative view, see Kliman, 2011, p124.

16 Choonara, 2017, p70; Harman, 2007.

17 Kliman, 2011, pp22-27.

18 See, for instance, Harvey, 2010, pp116-118.

19 Callinicos, 2014, chapter 6. See also Callinicos and Choonara, 2016.

20 Marx, 1993, p750.

21 Concentration involves the formation of large capitals through accumulation taking place over a period of time, whereas centralisation involves mergers and acquisitions among capitalist firms—see Marx, 1990, chapter 25.

22 To give some sense of this, data from the US business census 2007 suggests that the biggest eight firms in the chemical manufacturing sector are now responsible for over a quarter of the total value added, in computing and electronic products manufacturing about two-thirds. The biggest eight firms receive about two-thirds of the revenue in the general merchandising sector and in telecommunications; in commercial banking the figure is just short of half and in broadcasting just over half. According to the UNCTAD, by 2010, multinational corporations generated value equal to over one quarter of global GDP—UNCTAD, 2011.

23 The term “creative destruction” applied in this way is not confined to Marxist political economy. Indeed it was coined by Joseph Schumpeter: “creative destruction is the essential fact about capitalism. It is what capitalism consists in and what every capitalist concern has got to live in”—Schumpeter, 2003, p83.

24 Naturally, there was some restructuring of the US economy in the face of global competition and this too may have ameliorated the fall in profitability in that country—see Harman, 2007, pp151-152; Harman, 2001.

25 See Harman, 2009, chapter 7. The organic composition of capital is the ratio of value advanced in the form of constant capital (machinery, raw materials and other equipment) to variable capital (wages). See Choonara, 2017, pp61-63 for a discussion of this.

26 On the neoliberal policy regime, see Callinicos, 2012.

27 Cited in Jenkins, 2016.

28 By comparison, the ratio of fixed capital formation to GDP in Britain in 1875 was in the region of 13 percent. See the tables in Mitchell, 1971, pp367, 373.

29 Wolf, 2016.

30 One of the important trends in China’s explosive growth has been the rise in the organic composition of capital. In 1990 the amount of capital per worker was less than one 20th that of the US; by 2014 it was about a quarter and rising rapidly (see Zhang, 2016). Initially, countries that successfully break into global capitalist markets can experience high profitability founded on high rates of exploitation and growing productivity, allowing them to increase their relative surplus value on a world scale as they capture particular export markets. Over time the rising organic composition of capital, combined with growing integration into the world system, and, in some cases, the loss of the “advantage” of low wages to rivals with even lower wages, begins to exert a downward pressure on profit rates. Minqi Li argues that Japan, after its initial breakthrough, suffered a decline in profitability and that China may face the same fate—Li, 2007 (although I disagree with Li’s method of measuring profitability).

31 Kliman, 2011, chapter 3. Shaikh, 2016, p466 notes a more general shift in the years during which Alan Greenspan ran the Fed (1987-2006). Greenspan and his successors tended to lower interest rates regardless of the overall price level—in a break with the pattern across the whole period from the mid-19th century.

32 Cited in Elliott, 2017; see Zhang, 2016, p7 for credit-intensity estimates.

33 Cooney, 2016.

34 Word Bank, 2017, p4, table 1.1.

35 See Fine, 2013.

36 Marx, 1991, p742.

37 Lohr, 2015.

38 Marx, 1991, p363.

39 Marx, 1991, p596.

40 Marx, 1991, pp595-596.

41 Marx, 1991, p367.

42 Norfield, 2016, p140. CDOs were often wrongly regarded as “safe” investments, even when they were based on subprime mortgages. This was in part because, in conditions of rising house prices, even if people defaulted on their mortgage the home could simply be repossessed. The problems in 2007 developed when large numbers of defaults coincided with falling house prices. See also Duménil and Lévy, 2011, pp185-194.

43 Delivorias, 2016, p14.

44 Rennison and Smith, 2017.

45 For a useful account, see Norfield, 2012.

46 Duménil and Lévy, 2011, p112.

47 See the BIS release: www.bis.org/publ/otc_hy1711.pdf. In addition, some of the reduction may be due to “trade compression” in which multiple derivative contracts that offset each other are replaced with a single contract with the same exposure, reducing the replacement value, see Rennison, 2016. Most derivative contracts are described as “over-the-counter”. This simply means that they are concluded by two parties without using an intermediary, such as an exchange, which would impose greater regulatory constraints—Duménil and Lévy, 2011, p110.

48 Wolf, 2010.

49 According to Riccardo Bellofiore: “The Neoliberal Great Moderation was a paradoxical kind of financial and ‘privatised Keynesianism’. The heart of the Anglo-Saxon model was the attempt to overcome the stagnationist tendencies emerging from ‘traumatised workers’ resulting from the transformation of ‘manic savers’ into ‘indebted consumers’. This ‘autonomous’ consumption, fuelled by finance and bank debt, was the driving force of a dynamic but unsustainable ‘new’ capitalism, manipulated by an innovative kind of monetary policy”—Bellofiore, 2014, p7.

50 Kliman, 2011, p14; Roberts, 2016, pp25-29. See also, Choonara, 2009; 2014.

51 Popper and Gough, 2015.

52 Wolf, 2018a.

53 Wolf, 2018b.

54 Upchurch, 2018.

55 Quoted in Wearden and Elliott, 2018.

56 See Grossman and Woll, 2014.

57 See Lapavitsas and others, 2012.

58 Comfort, Salzano and Sirletti, 2018.

59 Central banks, although formally independent of government in most countries, are best seen as quasi-state institutions. As L Randall Wray points out, in the case of the Federal Reserve, the US central bank, given that the Fed is subject to the will of Congress, with most high ranking officials selected by elected politicians, and acts as the federal government’s bank, it is hard to sustain the idea that there is genuine independence. Moreover, the central banks remain embedded in networks that encompass the upper echelons of the civil service and other centres of state power. While formally independent central banks are less subject to the whims of and direct manipulation by governments, they share with the state more generally a systemic interdependence with capital—Wray, 2014.

60 Authers and Manibog, 2017.

61 Elliott, 2018.

62 McGowan, Andrews and Millot, 2017.

63 McGowan, Andrews and Millot, 2017.

64 BIS, 2017, pp41-58.

65 BIS, 2017, p52.

66 Cited in Verma, 2017.

67 S&P, 2017.

68 Cited in Spross, 2018.

References