Liz Truss, asked to form a new government in what turned out to be the dying act of Queen Elizabeth II, confronts one of the greatest crises for an incoming British prime minister with one of the weakest mandates.1

Truss is the third British prime minister in succession to take office on the basis, not of a general election, but of a leadership vote within the Conservative Party. Among the Tory membership—ageing, disproportionately white and male, concentrated in wealthy areas of the south of England, and espousing views far more reactionary than those of the general population—she won 81,326 votes from an electorate of 172,437.2 Her victory was by the smallest margin since the current Tory leadership election system was introduced in 2001.

Her base in parliament is also far from secure. In the final round of voting among Conservative MPs, to select the two candidates to go out to the ballot of party members, just 113 out of 358 cast their vote for Truss. True, she inherits Boris Johnson’s 80-seat majority in the House of Commons; however, her party is riven with factionalism, further complicated by the accumulation of former ministers, including leadership election contender, Rishi Sunak, on the back benches. She will, as a result, have to “govern like it’s a hung parliament,” as one Tory strategist put it.3

Having run her campaign on a Thatcherite agenda, promising “no handouts”, her first act as prime minister was to increase state-backed support in response to the energy-price crisis to an estimated £187 billion. This dwarfs the bailout during the financial crisis of 2007-9 and, as a state intervention outside of wartime, is exceeded only by the £376 billion response to the Covid-19 pandemic.4 This analysis will explore Truss’s economic agenda, discuss the conditions that have brought about this intervention and outline the contours of the crisis that the incoming government will have to navigate.

Unchaining the economy?

While Truss’s predecessor, Johnson, was widely seen as opportunistic in his pursuit of power, Truss comes from a cohort of more ideologically driven Tory MPs, elected in 2010 and gathered around the Free Enterprise Group parliamentary faction.

A decade ago, during the period of coalition government between the Tories and Liberal Democrats, Truss co-authored the book Britannia Unchained: Global Lessons for Growth and Prosperity with her now chancellor, Kwasi Kwarteng, along with Dominic Raab, Chris Skidmore and Priti Patel.5 Although widely (and rightly) decried as lacking intellectual coherence and drawing on sloppy research, the book’s overall ideological thrust is clear enough. Britain is, the authors argue, mired in “dependency culture”, and the British are the “worst idlers in the world”. This is contrasted with the work ethic of those in Singapore, South Korea, India and Mexico. Indeed, this can be extended to earlier generations of “Asian immigrants to Britain who had very limited possessions and no welfare state entitlements” and so “relied on hard work and, in essence, entrepreneurialism”.6 This “good immigrant” narrative helps reconcile the apparent contradiction between a government likely further to radicalise the racism of the Johnson years and a cabinet whose leading figures are disproportionately from migrant backgrounds. The book argues in favour of rebuilding an entrepreneurial, risk-taking culture and reducing red tape and regulation, which the authors see as restricting the dynamism of business.7

However, the approach mapped out ten years ago does not mean that Truss and Kwarteng envisage a return to neoliberalism’s “heroic” age, the era of Margaret Thatcher and Ronald Reagan, or even that of Tony Blair and Bill Clinton. That earlier period emerged towards the end of the 1970s as state-led methods of promoting capitalism, adopted after the Great Depression and reinforced by the mobilisation for the Second World War, ran up against their limits. The largest corporations’ operations increasingly overspilled national frontiers and the pattern of declining profitability, identified by Karl Marx in Capital, began to reassert itself, leading to a series of crises in the 1970s and early 1980s. The Keynesian orthodoxy proved incapable of reversing the decline—and the fully state capitalist economies of the Eastern Bloc fared worse still:

These changes underlay the shift towards widespread acceptance of neoliberal ideologies and the implementation of neoliberal policy regimes… The new approach combined efforts to restore the fortunes of capitalism by weakening workers’ organisation, to support cross-border trade and financial flows through deregulation, to promote fiscal and monetary stability, and to mobilise the state to bolster supposedly self-regulating markets as the prime mechanism for distributing resources and to insulate them from popular pressure… The turn taken…involved not so much a decline of state expenditure as its redirection… State expenditure rose or remained at similar levels in most advanced economies… However, the growing integration of capital across borders through the formation of multinational firms and the flow of finance between markets complicated matters. To a far greater degree than in previous periods, the interdependence of state and capital came under strain.8

Today, the neoliberal orthodoxy is no more. It has been overcome by two shifts. The first is the intensification of inter-imperialist rivalry, in particular competition with China as the emergent challenge to United States hegemony. The rise of China, a country in which the state explicitly plays a role in fostering economic advance, has forced competitors to reconsider the role of the state in their own economies.9 The second shift is the succession of crises—both economic and, increasingly, ecologically driven—that have spurred unprecedented levels of state intervention.10 We are in a new period, distinct from both the neoliberal era and what preceded it.

This is reflected in the approach of recent governments. When the pandemic hit, Johnson and Sunak found it necessary for the government to support around a third of the workforce through handouts to business, a level of state intervention that would make many traditional social democrats blush.11 Whatever their instincts, Truss and Kwarteng have similarly realised that it would be political suicide were the incoming government not to intervene in the cost of living crisis. Initially, it was thought that their plans might involve the government underwriting soft loans to the energy companies, which would then be paid back by consumers through elevated bills over several years. However, in the end they opted to cover the costs of the subsidy through increased public spending, even while promising substantial tax cuts for business—thus ensuring that state debt levels will reach eye-watering levels. This was preferred to the more obvious solution advocated by the left: seizing the “excess profits” energy firms are projected to make over the next two years due to price rises, expected to reach £170 billion according to a leaked Treasury report.12

In justifying the use of public funds, Kwarteng argues that the energy crisis is an “emergency situation” and that “in the medium term” higher growth levels will reduce the levels of debt.13 In fact, this kind of approach is not entirely without ideological underpinnings. The economist who has hitherto been most glowing in his support for Truss is Patrick Minford, best known for leaping to Thatcher’s defence after 364 economists wrote to the Times to decry her 1981 budget. Truss, in turn, has named Minford as a leading economist who agrees with her policies. Minford, though supportive of Brexit, was highly critical of Sunak and Johnson’s period in office, arguing:

National insurance is up. Corporation tax is going up. Sunak hasn’t indexed tax allowances. That’s a cool £50 billion. It needs to be cancelled and reversed. There needs to be a positive supply-side policy that’s aligned with fiscal policy that is counter-cyclical. That’s all been thrown to the winds by Treasury orthodoxy.14

In other words, Minford is sanguine about rising public debt in the short term, provided that “supply-side” measures—pro-business policies that slash taxes, promote trade and reduce regulation—are put in place to spur growth.15 This puts him at odds with many other right-wing, monetarist economists such as Tim Congdon. Congdon has said of Minford:

It is no secret Patrick and I don’t get on… I’m in favour of strong public finances and making sure governments can pay their bills. That’s part of what monetarism is about. Patrick has managed to get himself known as a monetarist without believing any of this stuff. Patrick is basically a Keynesian.16

George Magnus, a former economic adviser to the giant Swiss bank UBS, notes the logic behind Truss’s alignment with Minford:

You can see why Minford has Truss’s ear. She wants to cut taxes for political reasons, but knows that she must remain committed to expensive projects and programmes, including the highly sensitive triple lock on pensions, and the pledges to subsidise old-age care home costs, resource the NHS and old-age care systems, supply new rail projects, boost defence, build out energy capacity and deal with the current energy cost crisis. For Truss, the key to cutting taxes and maintaining high levels of public spending is growth.17

In adopting this approach, the incoming prime minister and her chancellor are, like Minford, happy to tolerate escalating debt levels.18 However, this comes as a package with their “supply-side” reforms, which include not just tax cuts but also confrontation with the unions and deregulation in spheres such as employment. Indeed, a 2012 report written by Truss argued that increasing regulation in Britain from 1997 to 2010 had harmed the economy, while in Germany deregulation, including the creation of low-paid, low-hours “mini-jobs” with tax incentives for businesses using them, had led to superior economic performance.19

Truss and Kwarteng also seem to accept that their approach involves a confrontation with what Minford refers to as “Treasury orthodoxy”. This orthodoxy asserts that expansionary fiscal measures such as tax cuts or greater state spending simply raise the cost of borrowing and “crowd out” private investment.20 Early moves by Kwarteng to sack Tom Scholar, the Treasury’s top civil servant, and tell Bank of England (BoE) officials to shift their focus to boosting growth to 2.5 percent have been interpreted as an attempt to overcome this orthodox approach. However, there is some debate about how entrenched the orthodoxy really is at the Treasury and BoE.21 In earlier periods, when the rate of inflation was at historically low levels, debt-funded interventions to bail out the economy were widely tolerated. Indeed, they were facilitated to a large extent by the BoE’s accommodative monetary policy. By contrast, the current context of high inflation is likely to push officials and economists back towards the orthodoxy:

The…view, held by almost all economists, is that the additional government borrowing and spending will ultimately be inflationary and that the central bank will need to respond with higher interest rates to foster price stability over the longer term. This latter view forms the foundation of the textbook case for a monetary authority independent of government… The delicacy of the BoE’s balancing act between orthodox economics and not being seen as obstructive to the new Truss government was illustrated on Wednesday 7 September. Efforts by governor Andrew Bailey to avoid talking about policy were interpreted as a dovish act by international investors, sending sterling to its weakest levels against the US dollar since 1985.22

This should put paid to any idea that the turmoil at the top of society, including rows involving Downing Street, big business and the BoE, which characterised the periods of the Johnson and Theresa May governments, will ease under Truss. On the contrary, we should expect a highly volatile politics, reinforced by the clash between the rival approaches to economic policy and the brutal reality of an economy dependent on state intervention.

The continuing crisis

The underlying, long-term weaknesses of capitalism make the idea that supply-side methods can resolve the problems faced by the British economy seem like a piece of magical thinking. That the world faces an overlapping series of economic, ecological and geopolitical crises has now become a truism, reflected in commentary across the political spectrum.

All of the major Western economies have suffered from the consequences of a long depressive phase of capitalist development. This reflects the tendency for profit rates to fall, identified by Marx, and a blunting of the capacity of crises to clear out unprofitable capital, due to the increasing size of the dominant firms and their growing entanglement with the state. Repeated state and central bank interventions have, in turn, created a world in which growth increasingly relies on credit expansion and financial innovation, and in which “zombie firms”, kept alive by cheap credit without engaging in major investments, persist beyond their natural lifespan.23

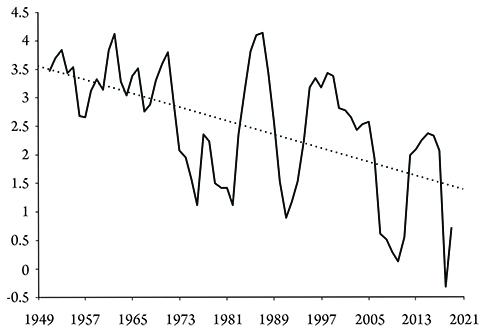

Britain, more than most countries, has seen stagnating investment and an overreliance on the financial sector to drive the economy, along with growth that has trended down since the Second World War (figure 1). Productivity also declined from the 1970s before stagnating, to a degree not seen in 250 years, from 2007, as the dynamism of the financial sector, and high-tech industries such as telecommunications and pharmaceutical production, exhausted itself.24

Figure 1: British annual percentage GDP growth, five year moving average with trend-line

What has become increasingly evident in recent years is the way the ongoing economic malaise now intertwines with an escalating ecological crisis. That applies to the increasing likelihood of viral pandemics, brought about by capital’s disruptive incursions into ecosystems. Alongside that, we have the growing impact of climate change. Along with the global pattern of wildfires, discussed by Ian Rappel’s article in this issue, we have seen catastrophic flooding in Pakistan, which has killed 1,500 people and will impose estimated costs of $10 billion on the country. Pakistan had already sought a $1.1 billion International Monetary Fund (IMF) loan to avoid a default on its debt, necessitated by surging costs of energy and other commodities. Meanwhile, unprecedented temperatures in China are driving a drought that has added to the disruption to global production networks, alongside ongoing Covid-19 lockdowns. Hydropower facilities in Sichuan province, which export electricity to China’s main manufacturing centres, have suffered plummeting capacity, even as demand for air conditioning has driven record levels of demand for power. As a result, authorities felt forced to order manufacturing plants to shut down, shuttering production at Toyota and Foxconn.25

As these effects multiply, what might be seen as a series of isolated disruptions to the production and supply of goods, begins to morph into a longer-term pattern.26 One result will be a long-term upward pressure on commodity prices. There will also be disruption to existing energy regimes, as some sections of the global ruling class seek, ineffectually and chaotically, to decarbonise, while others push in the opposite direction.27 In the case of Truss’s incoming administration, the latter approach is in the ascendancy, with the new prime minister lifting the moratorium on fracking, imposed by her predecessor in 2019, and promoting further extraction of North Sea oil and gas. Fracking companies responded by demanding a ripping up of planning and earthquake prevention regulations.28

Inflation and the coming recession

The most immediate source of crisis is, of course, the inflationary spike we are witnessing in Britain and many other countries. As I have previously argued, the immediate trigger for this was the collision of disrupted supply and surging demand as the Covid-19 restrictions lifted, followed by the war in Ukraine and Western sanctions on Russia that have impacted energy and food prices.29 This has been reinforced by both financial speculation and efforts by oil and gas producers to keep prices elevated.

Although there was evidence in early autumn of oil prices easing, gas prices, critical for European energy production, remained extremely high. An 80 percent cut to European imports of Russian gas imposed by Vladimir Putin, with the threat of a complete shutdown if the European Union goes ahead with a price cap on its gas, has further increased the pressure on markets. There is now a real prospect of power cuts in Europe over the winter.

However, the inflationary surge is not simply a product of energy and food price rises. It is being kept alive by firms bolstering their profit margins by raising prices. At least in the US case, over the past two years price rises have been driven by a combination of firms passing on the rising costs of inputs and increasing their profits. Between the second quarters of 2020 and 2022, 40 percent of average unit price rises were increased profit, 38 percent increased non-labour costs. Only 22 percent was due to increased labour costs.30

Not only have wages, thus far, contributed far less to inflation, but in countries such as Britain they have plummeted in real terms. Labour markets remained tight over the summer, with more vacancies than those officially unemployed—although large numbers also dropped into the category of “economic inactivity” due to factors such as long-term illnesses. However, the relative shortage of workers was only enough to lift private sector earnings by 6.4 percent in July 2022, compared to a year earlier, with those for the public sector just 2.4 percent up. The Retail Price Index measure of inflation for the same month was 12.3 percent. In real terms, pay had fallen by July by an average of 5.9 percent in the private sector and 9.9 percent in the public sector.31 This was before the sharp increase in energy costs, which Truss’s price cap will only partly offset.

If the impact on workers in Britain is brutal, in many areas of the Global South the outlook is worse still. Surging energy and food costs there are accompanied by the disruptive effects of a strengthening dollar, which had, by mid-September, risen 14 percent against a basket of currencies since the start of the year. As the economic outlook has worsened, investors have sought to plough their money into dollar assets, seen as a safe haven in moments of crisis, particularly given the fragility of the European and Chinese economies. This is exacerbated by the US Federal Reserve raising interest rates faster than other central banks, making its bonds more attractive. As the editors of the Financial Times note:

The strength of the dollar…has profound implications. In advanced economies, central banks are playing catch-up with the Fed to avert a further weakening of their currencies—which also raises imported inflation. Rising rates are all the more problematic for some as energy crisis borrowing adds to already high pandemic debt piles. In emerging countries it threatens balance of payment crises by raising dollar-denominated debt burdens and driving disruptive capital outflows. About 20 emerging markets have debt that is trading at distressed levels, according to the IMF.32

Sri Lanka is already in the grip of a major crisis, as the update from Ahilan Kadirgamar in this issue of International Socialism explains. Now, there are signs of the interlinked debt, currency and cost of living crisis spreading.33 Alongside Pakistan’s resort to the IMF, Bangladesh is also seeking assistance as it struggles with energy shortages and increasing import costs. In Africa food and fuel costs risk pushing tens of millions more into extreme poverty. The list of countries facing developing debt crises includes Chad, the Republic of Congo, Mozambique, Somalia, Sudan and Zimbabwe.34 Zambia has already defaulted, obtaining a $1.3 billion IMF loan, after China, which owns $6 billion out of the country’s $17 billion external debt, agreed in principle to absorb losses. The conditions attached to IMF assistance, including the slashing of fuel and agricultural subsidies, will worsen the cost of living crisis, a reminder that such debt relief comes at a price.35

Yet, as noted above, faced with spiralling costs, the instinct of central banks remains to raise interest rates, with the evidence suggesting that Jay Powell, chair of the Federal Reserve, believes the current cycle of quantitative tightening (the withdrawal of liquidity from financial markets in a reverse of quantitative easing) and increased borrowing costs is far from over.36 As this gathers pace, it will increasingly become a battle of competitive interest rate hikes.37 This in turn threatens to choke off the supply of cheap credit that has come to sustain the dysfunctional global economy over the past few decades. A recession looms, hot on the heels of the inflationary crisis.

Political prospects

It is this complex, crisis-filled landscape that the brittle incoming Truss administration will need to navigate.

The pain likely to be experienced by the working class—along with small businesses, who have less capacity to raise prices than the multinationals who dominate the economy—will further undermine the Conservatives’ base of support. Johnson’s success, electorally, was to use the issue of Brexit to win over voters who remained committed to state intervention in the economy, particularly in formerly Labour-voting areas of the North of England and the Midlands. For a time, he could shore up his support through his pragmatic intervention during the pandemic, including the furlough scheme and other state-funded measures. A recent study by the Conservative analyst James Frayne suggests that less affluent working-class Leave voters, who Johnson sought to attract, tend to want higher taxes for the rich and big business, are typically more worried about inflation than most and would have greater difficulties paying an unexpected bill of £100.38 Truss’s cap on energy prices might well be welcomed by this group, but it will only somewhat alleviate, and not reverse, the pressure of rising living costs.

Moreover, the growing burden of state debt as interest rates rise, and the sense that intervention might add to inflationary pressures, have, as noted above, left Truss with far less room for manoeuvre than her predecessor.

Faced with these political difficulties, Truss will almost certainly intensify her adoption of hard-right rhetoric and policies to try to undermine resistance and unify her core Conservative support. This parallels developments elsewhere in the world. In the US the repeal of Roe v Wade by the Supreme Court, analysed in this issue by Judith Orr, and the appeal of Republican candidates backed by Donald Trump in the primaries ahead of midterm elections, show the continued strength of radical right-wing politics. Meanwhile, the Sweden Democrats, a party rooted in that country’s neo-Nazi movement, emerged as the second largest party and the largest on the right in early September’s general elections. At the time of writing, the Fratelli d’Italia (Brothers of Italy) party, led by the fascist Giorgia Meloni, was poised to win elections set for late September, where it was expected to form a government with Matteo Salvini’s Lega (League) and Silvio Berlusconi’s Forza Italia.

Here in Britain, continued attacks on migrants and refugees will likely be combined with offensives against what Truss condemns as “woke” politics, encompassing everything from transgender rights to criticisms of Israel. The appointment as health secretary of Thérèse Coffey, whose anti-abortion views are well-known, is not a good sign.39 The left will need to continue to build movements and struggles over these issues. There will also be intensified attacks on unions and workers’ rights:

Truss has vowed to start “cracking down” on striking dockworkers like those at Felixstowe Port… In a move that could further restrict teachers, postal workers and the energy sector, the Truss campaign has floated legislation in her first 30 days to require minimum service levels on critical infrastructure, in a bid to further rein in organised labour… She is also reportedly tasking Jacob Rees-Mogg—confirmed as her new business secretary—with a review of existing worker protections, including limits on a 48-hour work week and rules on taking breaks.40

There is little sign of resistance from the Labour Party over these issues. Faced with an uptick in strike action over the summer, analysed by Mark Thomas in a separate article complementing this analysis, Labour leader Keir Starmer’s response was to condemn the action and instruct frontbench colleagues to stay away from picket lines. When Labour’s shadow transport minister, Sam Tarry, said that workers should receive a pay rise, Starmer sacked him.

In the absence of leadership from Labour, the best defence for workers, and the best possible way of blunting the incoming Truss government’s offensive and breaking her government, is through nurturing and developing the strike movement. As Thomas’s article argues, though the union leaders and officials often feel compelled to call action, the double-edged nature of the trade union bureaucracy means that they can just as easily vacillate and close down strikes. Indeed, this was seen rather dramatically when strikes were called off in the wake of the death of the British monarch. The antidote to this is building powerful rank and file networks that can take control of the action, as well as pushing for coordinated action between unions. The ability of the left to achieve this will help shape the outcome of what could turn out to be a serious outbreak of open class struggle in Britain.

Joseph Choonara is the editor of International Socialism. He is the author of A Reader’s Guide to Marx’s Capital (Bookmarks, 2017) and Unravelling Capitalism: A Guide to Marxist Political Economy (2nd edition: Bookmarks, 2017).

Notes

1 Thanks to Richard Donnelly, Jacqui Freeman and Sheila McGregor for feedback on an earlier draft. We plan to analyse the institution of the monarchy in a forthcoming issue of International Socialism. The protracted decline and fall of Boris Johnson were discussed in Taylor, 2022.

2 The Communication Workers Union was quick to point out that the votes received by Truss to put her in Downing Street were about 4,000 fewer than the number cast in favour of strikes in Royal Mail—https://twitter.com/CWUnews/status/1567167895972577280. On the composition of the Conservative Party, see Bale, Webb and Poletti, 2018.

3 Payne, 2022.

4 Elgot, Walker and Lawson, 2022.

5 Kwarteng, Patel and others, 2012. Aside from Skidmore, appointed to head a review of net zero emissions policies, the other authors have not fared so well. Patel pre-emptively resigned as home secretary before Truss could replace her with Suella Braverman, who has, astonishingly, promised an even more draconian approach towards refugees and migrants. Raab was sacked as justice secretary, having backed Sunak in the leadership election.

6 Kwarteng, Patel and others, 2012, pp2, 61, 65 and 73.

7 One of the more bizarre elements in the book is the emphasis on the optimism and dynamism of the Brazilian economy under its then social-democratic president, Luiz Inácio Lula da Silva, whose support was derived in large part from anti-poverty measures such as the Bolsa Família (“family allowance”)—Kwarteng, Patel and others, 2012, pp100-106. Nonetheless, Brazil’s trajectory may indeed foreshadow that of Britain—per capita GDP there has been in free fall pretty much since the book was published.

8 Choonara, 2021, pp9-10.

9 Britannia Unchained also emphasises the need to “learn from the successes of China”, even if it also rather bizarrely claims China as a success for the “spirit of enterprise”, with the Communist Party merely retaining its grip on the “political system”—Kwarteng, Patel and others, 2012, p113. See also Choonara, 2021, pp12-16.

10 Choonara, 2021, pp16-18. For a broader discussion of the context of these crises and the resulting intervention, see Choonara, 2018.

11 Choonara, 2022a.

12 Wickham and Gillespie, 2022.

13 Kwarteng, 2022.

14 Cited in Elliott, 2022a.

15 Davies, 2022.

16 Cited in Elliott, 2022a.

17 Magnus, 2022. Magnus points out, as does left-wing economist James Meadway (2022a), that this is not dissimilar to Modern Monetary Theory (MMT), advocated by many on the left, which suggests debt does not matter in the short term provided monetary authorities can issue their own currency. If MMT is a leftist shortcut, sidestepping the actual problems of value creation in a period of depressed growth, and hence the need to confront capital in a more systematic manner, supply-side economics of the kind advocated by Minford plays a similar role for the right.

18 In the case of Kwarteng, we also have a fairly explicit statement of his views in his book War and Gold (Bloomsbury, 2014). He criticises Western governments not for using Keynesian-style expansionary fiscal measures, but for continuing to do so during booms. Amusingly, and at the risk of starting a conspiracy theory, alongside “repudiation” of public debt and states growing their way out of debt, he notes inflation can be used to “surreptitiously” reduce debt. He cites John Maynard Keynes: “By a continuing process of inflation, governments can confiscate, secretly or unobserved, an important part of the wealth of their citizens.” Inflation can indeed have big redistributive effects, but I doubt Kwarteng would choose for Britain to face such high levels.

19 Truss, 2012; see also Trades Union Congress, 2012.

20 Elliott, 2022b.

21 See Lambert, 2022.

22 Giles, 2022.

23 Choonara, 2018.

24 See Riley, Rincon-Aznar and Samek, 2018; Crafts and Mills, 2020.

25 Riordan, Li and Lin, 2022.

26 Meadway, 2022b, makes this point well. Although I agree with the thrust of his analysis, I think he needlessly downplays the various short-run factors driving the current cost of living crisis.

27 It is worth noting that record global investment in renewables in 2021, at $446 billion, still falls well below global investment in carbon-based fuel supply, at $794 billion—see International Energy Agency, 2022.

28 Tani and Thomas, 2022.

29 For my analysis of inflation, see Choonara, 2022b. See also my talk, alongside Michael Roberts, at Marxism 2022—www.youtube.com/watch?v=YBtUve71-TA

30 Data from US Bureau of Economic Analysis, NIPA table 1.15.

31 The data also strongly suggests that the vacancy rate has started heading down from exceptionally high levels reached in late 2021 and early 2022. If that is the case, labour struggle will play a far bigger role than labour shortages in securing increased wages. For the data, see Office for National Statistics, 2022.

32 Financial Times, 2022.

33 Tony Phillips explores the issue of hunger in driving protest movements elsewhere in the issue.

34 See the list here: www.imf.org/external/Pubs/ft/dsa/DSAlist.pdf.

35 Cotterill, 2022.

36 For commentary on Powell’s speech at the Jackson Hole symposium of central bankers and the threat of a new recession, see Roberts, 2022.

37 Wei, 2022. Shang-Jin Wei also points out that 66 smaller economies peg their currency to the dollar and are essentially compelled to raise interest rates in line with the Federal Reserve, regardless of the harm to their own economy.

38 Frayne, 2022, pp19, 20 and 25.

39 Coffey has pledged not to change abortion law, but, even if she keeps this promise, it is hard to imagine her improving access to abortions and easy to envisage greater obstacles being placed in the way of those seeking them.

40 Lanktree, 2022.

References