The global capitalist crisis has now reached its half-decade point, and the months leading up to this unhappy anniversary saw the publication of a number of interesting papers on Marxist political economy. Here I will briefly survey some of them, focusing on those dealing with themes that have featured prominently in International Socialism.

A paper by Andrew Kliman and Shannon D Williams, “Why ‘Financialisation’ Hasn’t Depressed US Productive Investment”, builds on one of the controversial arguments in Kliman’s latest book.1 It challenges the idea that from the early 1980s financialisation caused the fall in the rate of accumulation (the rate at which profits are ploughed back into investment).

Over the past three decades the scale of financial payments (interest, dividends, etc) and financial assets swelled enormously, including in the non-financial sector. Kliman and Williams argue that this growth was not caused by firms diverting profits away from productive investment as people generally assume. Instead, “the substantial increase in corporations’ financial acquisitions has been funded by means of borrowing”. If this is the case, an alternative explanation for the slowdown in accumulation in the US is required. The authors argue that the major cause was the

long-term decline in the rate of profit during the post-war period.

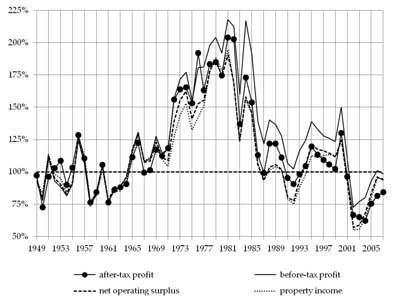

While it is also true that the share of profits going towards accumulation has declined somewhat since the early 1980s, they argue this is not due to financialisation; it is instead because in the 1970s the share had risen to unsustainable levels (see figure 1). The decline simply meant it had fallen back to levels similar to those between 1949 and 1971.

Figure 1: Investment shares of profit, US corporations

Another paper examining the relationship between finance and the wider economy is by Alan Freeman.2 Its central claim is that the profit rate should be “corrected” to take into account the growth of financial assets.

Government statisticians do not publish a “Marxist profit rate”. It is usually approximated by dividing some measure of the profits corporations make by their investment in fixed assets. Freeman’s argument is that their total investment in financial assets should be added to their fixed assets. He shows that if it is calculated this way the rate of profit for the UK economy falls steadily in the post-war period, and the US rate of profit falls faster and further than in most other estimates. Without this “correction”, Freeman argues, the UK profit rate would appear to have rebounded substantially from the early 1980s.

It is true that the competing financial claims over the profits generated by capitalist firms can become a problem for the system. “Deleveraging”, destroying some of the debts created prior to a crisis, is one of the ways that crisis itself can help to pave the way for a new boom, alongside the bankruptcy of unprofitable firms and attacks on workers.

However, there are problems with throwing financial assets together with fixed assets.3 As Freeman acknowledges, we are dealing here with what Karl Marx calls fictitious capital. This consists of paper claims over profits expected in the future-shares and bonds, for example. Marx argues that these claims circulate according to their own laws of motion through financial markets. But if their market prices happen to rise, I do not see why the rate of profit should be reduced. Even more problematic, in the case of shares, Marx argues that “the capital does not exist twice over, once as the capital value of the ownership titles, and then again as the capital actually invested in or to be invested in the enterprises in question”.4 This apparent multiplication of capital means that in the world of finance we have to be careful to avoid “double counting”. Freeman is right to raise the issue of what to do with financial assets, but I suspect a great deal more work remains to be done.

A third paper considering some of these themes is a fascinating piece in Historical Materialism by Tony Norfield, formerly executive director and global head of currency strategy at ABN AMRO bank and now a PhD student researching Marxist crisis theory!5 He presents an admirably clear explanation of how derivatives work. These are financial contracts whose market price changes based on something else-the movement of interest rates or the price of oil, say. They are traded without the underlying “something” they are based on changing hands.

He takes issue, rightly in my opinion, with the influential account by Dick Bryan and Michael Rafferty in their book Capitalism with Derivatives.6 Norfield argues that, contrary to the claims made by Bryan and Rafferty, derivatives cannot be seen as a new form of money. In addition, the price of derivatives can be highly unstable. Often the underlying “something” is itself a form of fictitious capital and, writes Norfield, a “derivative on fictitious capital…has a value that is regulated in yet another independent manner, even further removed from the underlying capital or commodity on which it is ultimately based”. The market in derivatives brings together capitalists who want to “hedge” against a particular risk (for instance, by purchasing a derivative contract that pays up if the price of a commodity they are planning to buy in the future changes, covering any losses they incur) and those engaged in speculation (buying derivatives in the hope that their price will rise), and in practice it is difficult to draw a precise line of demarcation between hedging and speculation. But both flow out of the logic of capitalism, rather than being an anomaly that can be regulated away.

Norfield argues that the recent growth in derivatives flowed out of the period of subdued profitability-”banks and other corporations”, faced with low profitability elsewhere and, after 2001, taking advantage of a wave of cheap credit, looked “for other sources of profit”. He traces the explosion of these markets in the run-up to 2008 and criticises the proposed regulation of derivatives since as “attempts to install fire-doors in an earthquake-damaged skyscraper”. Such reforms are, he argues, likely to fail and in any case will not resolve the underlying laws of motion driving capitalism towards crisis, and the speculative bubbles it periodically creates.

Guglielmo Carchedi, who has an article in the current issue of this journal, has produced an interesting paper on the relationship between the general tendencies driving world capitalism towards crisis and the specific problems faced by the eurozone.7 The first part of his paper covers the decline in the rate of profit, making this central to his explanation of the crisis.8 Carchedi goes on to look at the structural problems built into the euro, which he argues was conceived as a potential competitor to the dollar as a world currency, and the dilemmas facing ruling classes across Europe.

Interestingly, he also challenges the view commonly held on the left that the imbalances that have grown up between Germany and weaker European economies reflect the more successful repression of wages imposed on German workers since the euro was launched.9 He instead sees it primarily as the result of greater rises in efficiency in German industry (everyone accepts that the German economy started from a higher level of productivity than, say, Greece). He concludes by arguing that, while leaving the euro and devaluing the currency might help weaker countries to export more, this would come at the price of reducing the amount of value they can appropriate at an international level (because their new currency would fall rapidly in value) and potentially even reducing their profitability.

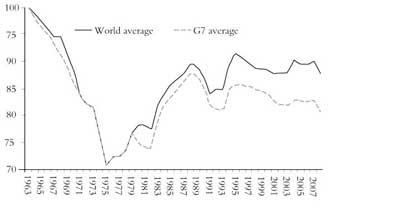

Michael Roberts, who runs the magnificent blog “The Next Recession”, has written a paper entitled “A World Rate of Profit”.10 His average global rate is painstakingly estimated by combining data from the big G7 economies, plus Brazil, Russia, Indian and China (the so-called “BRICs”), which, taken together, make up a large chunk of the world system (see figure 2). Roberts concludes that “there was a fall in the world rate of profit from the starting point of the data in 1963 and the world rate has never recovered to the 1963 level in the last 50 years. The rate of profit reached a low in 1975 and then rose to a peak in the mid-1990s. Since then the world rate of profit has been static or slightly falling and has not returned to its peak of the 1990s.” This is useful confirmation, for those of us who concentrate on the US data, that patterns globally were not entirely dissimilar.

However, I think the paper tends to overstate the degree to which the global economy is integrated by the flows of capital between national economies. Of course, capitalism is a global system-no major economy has been able to exempt itself from the consequences of the crisis, for example. But, despite low wages in less developed countries, it remains the case that capitalists in the most developed economies direct the bulk of their investment towards themselves or other highly developed economies, or to quite specific regions elsewhere (notably in recent decades the coastal regions of China) in particular sectors.11

Figure 2: A world rate of profit (index: 100 = 1963)

In other words, either capitalists do not generally anticipate obtaining higher profits from less developed economies or there are significant barriers to the flow of capital to these economies. There may be a tendency towards the formation of a global rate of profit, but this remains a tendency, and an uneven one, so what we are looking at is an average of different, but interacting, national profit rates. Roberts’ paper is useful in looking in broad terms at the global economy and its general health; it would be complemented by more detailed analyses of where capital does actually flow and the sectors of the world economy in which there is convergence of profit rates. Unfortunately, few Marxists seem to have delved deeply into this area.12

Roberts has also made available a collection of ten attempts to explain the crisis in 1,000 words or fewer-”Radical Economic Theories of the Current Crisis”-prepared for a joint summer conference involving the Occupy movement and the Union for Radical Political Economics in the US.13 This contains a range of Marxist, left wing Keynesian and other heterodox approaches, with contributions from Steve Keen, Andrew Kliman, David Kotz, Arthur MacEwan and John Miller, Fred Moseley, Thomas Palley, Jack Rasmus, Anwar Shaikh, Richard Wolf and Roberts himself. Though the quality of these essays is uneven, their brevity and their intended audience mean that they form an easy introduction to the various contending accounts of the crisis on the left.

Those wanting a more sophisticated survey, covering just Marxist explanations, should look at the recent paper by Deepankar Basu and Ramaa Vasudevan.14 The authors write, “A survey of literature is confronted by a daunting excess of conflicting characterisations”.15 They focus on the US profit rate and present a huge range of potential measures.

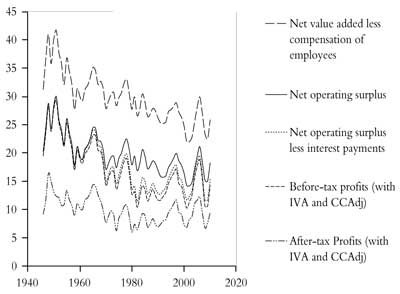

One issue in measuring profit rates is whether to value the assets of corporations at their historical costs (the value that they were purchased at) or their replacement costs (the value that would have to be spent to replace them with similar assets today). The authors are quite dismissive of historical cost calculations. However, such a measure allows us to compare the amount capitalists actually invested at a certain point with the profit they subsequently realise. Kliman has put the strongest arguments for historical cost calculations. Kliman also argues that various different measures are possible on this basis-for instance, using broader or narrower conceptions of profit, depending on the question you are trying to answer. In this spirit, Basu and Vasudevan’s paper is interesting as it presents figures that show what happens to the profit rate if you deduct corporate taxation, interest payments, depreciation costs, etc from the broadest possible measure (figure 3 shows their results using historical costs)

Figure 3: Various measures of % rate of profit using historic costs

The historical cost profit rates appear to fall or stay more or less trendless from the early 1980s. On that basis I cannot agree with the authors when they argue that the current Great Recession is not the result of a crisis of profitability. Their argument makes a lot of the differences between the years preceding 2007 and the run-up to the Great Depression in 1929. But why assume that all crises of profitability will manifest themselves in the same manner? Most writers associated with this journal have seen the Great Recession as the product of a long period of subdued profitability in which crisis was deferred by the expansion of credit, finally erupting when this process reached its limit.16

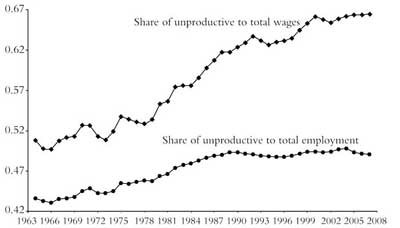

Finally, in autumn 2011 Review of Radical Political Economics published an interesting paper by Dimitris Paitaridis and Lefteris Tsoulfidis, entitled “The Growth of Unproductive Activities, the Rate of Profit, and the Phase-Change of the US Economy”.17 This considers the impact of the growth of areas of the economy in which labour does not generate surplus value (the source of profit), a theme that authors such as Fred Moseley have explored in the past.

The authors note, “The growth of unproductive activities is induced by the intensification of competition which forces capital to spending increasingly more resources in sales promotion, administration and supervision… Furthermore, social cohesion requires increasingly more resources to be devoted to the provision by the government of social security benefits… Finally, international competition…exerts a permanent pressure on governments to increase their military expenditures.” They claim that this kind of employment has risen to very high levels in the US in the post-war period (see figure 3), though they also indicate some of the difficulties in calculating the numbers. They argue that the “net” rate of profit, taking these expenditures into account, has never returned to the kinds of levels it experienced in the 1960s.

Figure 4: The share of unproductive labour and wages

Together this new body of writing on the causes and nature of the crisis show that the revival in Marxist political economy we have seen in recent years continues, even if it seems to generate as many new questions and controversies as answers.

Notes

1: Kliman, 2012. The paper is available from Kliman’s website: http://akliman.squarespace.com/writings. Elsewhere on the same site (http://akliman.squarespace.com/crisis-intervention) is his talk and PowerPoint presentation from the recent Marxism 2012 conference in London, which covers some of the themes in his book.

2: “The Profit Rate in the Presence of Financial Markets: A Correction”. I have only seen an early draft. A later version will hopefully be published this autumn in the Journal of Australian Political Economy.

3: Freeman actually uses “financial derivatives, investment position, all sectors” to measure financial assets.

4: Quoted in Freeman’s paper.

5: “Derivatives and Capitalist Markets: The Speculative Heart of Capital”, Historical Materialism, volume 20, issue 1. Those wishing to read the article will need to buy a copy of the journal or obtain it via a library as it does not appear to be freely available online.

6: Bryan and Rafferty, 2005.

7: “From the Crisis of Surplus Value to the Crisis of the Euro”, available from http://tinyurl.com/GC-euro

8: Carchedi, 2011, sets out his position on the crisis in some detail.

9: This is the argument, for example, of Lapavitsas and others, 2012, and the papers by the same authors available from www.researchonmoneyandfinance.org. Lapavitsas compares nominal unit labour costs across the eurozone, showing that the total compensation going to workers has stayed in line with productivity in Germany, but risen for the weaker economies; furthermore, he presents evidence that productivity growth for Germany was modest compared to many other economies. See Lapavitsas and others, 2012, pp23-28. Carchedi, by contrast, looks at GDP divided by labour hours, and the total labour hours, for just Germany and Italy.

10: http://thenextrecession.files.wordpress.com/2012/07/roberts_michael-a_world_rate_of_profit.pdf

11: Roberts also appears to accept the idea of “super-exploitation”, by which he means that workers in less developed countries receive less than the value of their labour power and that there is appropriation of surplus value from poorer nations by richer ones. The first concept implies a single universal standard for the value of labour power; the second seems to suggest exploitative relations between nations, as opposed to classes. I remain sceptical about such approaches.

12: Though one recent noteworthy attempt to grapple with some of the issues is George Liodakis’s “Transformation and Crisis of World Capitalism: Long-run Trends and Prospects”, available from Roberts’ website: http://thenextrecession.files.wordpress.com/2012/07/liodakis_george-transformation_and_crisis_of_world_capitalism.pdf

13: http://thenextrecession.wordpress.com/2012/08/16/ten-views-on-the-causes-of-the-crisis/

14: “Technology, Distribution and the Rate of Profit in the US Economy: Understanding the Current Crisis”, available from: http://people.umass.edu/dbasu/BasuVasudevanCrisis0811.pdf

15: See Choonara, 2009, for my own, much earlier, survey of Marxist accounts.

16: The authors also offer an attempt to decompose the changes in the profit rate into their constituent factors, though their narrative depends on their preferred reading of the movement of profit rates. Despite this it does suggest that to a large degree the decline in profitability is a result of an increase in the value of fixed assets required to generate a given level of output.

17: Review of Radical Political Economics, volume 44, number 2. Unfortunately, this paper does not seem to be freely available online.

References

Bryan, Dick, and Michael Rafferty, 2005, Capitalism with Derivatives: A Political Economy of Financial Derivatives, Capital and Class (Palgrave Macmillan).

Carchedi, Guglielmo, 2011, “Behind and Beyond the Crisis”, International Socialism 132 (autumn), www.isj.org.uk/?id=761

Choonara, Joseph, 2009, “Marxist Accounts of the Current Crisis”, International Socialism 123 (summer), www.isj.org.uk/?id=557

Kliman, Andrew, 2012, The Failure of Capitalist Production (Pluto).

Lapavitsas, Costas, and others, 2012, Crisis in the Eurozone (Verso).

Roberts, Michael, 2009, The Great Recession (Lulu).