The ancestor of modern cheap food policies, the repeal of the Corn Laws in Britain in 1846, was spurred by growing unrest within the swelling cities of an industrialising economy. In 1848 that unrest burst out into a series of revolutions across western Europe.

It is not often that the Financial Times warns of impending revolution unless governments act to stem the consequences of untrammelled market capitalism, but that is exactly what Alan Beattie argued in April 2008.1 The leaders of the World Trade Organisation, the International Monetary Fund and prime minister Gordon Brown, to name but a few, have echoed such comments.

They have much to warn about. By early April 2008 food protests had already occurred in Mexico, Haiti, Ivory Coast, Guinea, Senegal, Mauritania, Morocco, Egypt, Yemen, Mozambique, India and Indonesia. Kazakhstan, Ukraine, Russia, China, India, Vietnam, Cambodia and Argentina had all imposed restrictions upon exports. Even large US retailers had begun to ration rice. Rapidly rising food prices are destabilising much of the developing and developed world, impacting upon billions of the world’s population.

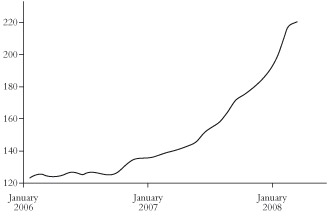

Figure 1: Food price index

Source: Food and Agriculture Organisation (FAO) of the United Nations

Figure 1 shows just how rapidly food prices have risen. The upward pressure on prices is likely to increase. The UN’s Food and Agricultural Organisation says that the world’s food import bill will surge above $1 trillion this year for the first time, an increase of about 20 percent from 2007. The food import bill of the poorest countries, those facing a food deficit, is likely to climb to $169 billion—a 40 percent increase. And “prices are unlikely to return to the low levels of previous years”.2

Short-term causes

Four key factors caused the rising prices of the past 18 months:

- Crop yields have fallen in Australia due to lack of rainfall and in northern Europe because of too much. This suggests that climate change is having an impact on the geography of food production.

- Much of the US’s maize crop has been turned over to biofuel production, encouraged by government subsidies. This alone is responsible for about a third of the grain price increase.

- Increasing meat consumption by the middle classes in China and India is pushing up the demand for grain to feed animals.

- Every increase in oil and gas prices raises farming costs, since it raises the cost of transport, using mechanised equipment, and of pesticides and nitrogen-based fertilisers (which are produced using energy intensive processes).3

The failure of the global food production system to respond to these short-term problems points to a deepening long-term fault within it. Throughout the 20th century there was always a surplus of food worldwide; famines resulted from failures of distribution, not production. But today “global grain inventories…are at 40-year lows, equivalent to just

15 to 20 percent of annual demand”.4 This means that harvest failures due to climatic conditions in one region of the world can be disastrous globally. We are now faced with a problem in production, not just distribution. This has its origins in the organisation of capitalist markets.

How the market threatens food security

Rising food prices have been an explicit goal, not an unwelcome by-product, of the wave of agricultural trade “liberalisation” of the past two decades. The IMF estimated in 2006 that import costs for net food importers would increase by “$300 million to $1.25 billion, depending on the degree of liberalisation”.5 The World Bank estimated that full liberalisation would raise international commodity prices by an average of 5.5 percent.6

A key element in the Structural Adjustment Programmes (recently renamed Poverty Reduction Programmes) imposed by the IMF across the developing world since the 1980s has been to shift these countries towards the production of high value cash crops to trade on world markets. Developing countries are then supposed to be able to increase living standards by using the earnings of trade to purchase other foodstuffs cheaply.

By the late 1990s over 80 developing countries had implemented such programmes.7 Coffee was one “high value” crop. By 2000 it had spread to over 80 countries, covering over 100,000 square kilometres with an output of 5.7 million tonnes a year.8 The same approach was pursued with, for example, tobacco in Malawi, oranges in Brazil, cotton in Burkina Faso and cut flowers and fresh vegetables in Kenya. In each case cash crops replaced foodstuffs for the local population on large swathes of land.

The economic theory of “comparative advantage” underpinned this approach. “Gains from trade” were supposed to arise as each economy specialised its production processes. However, the theory ignored how markets really operate. Joseph Stiglitz, former chief economist at the World Bank, criticised the IMF’s approach as “based on the outworn presumption that markets, by themselves, lead to efficient outcomes”.9

Dominant organisations are able to use their market power to capture the “gains from trade” to the detriment of the weaker parties. One way for dominant firms to do this is to ensure that they maintain strict control over supply chains. So just six firms controlled over 84 percent of Kenya’s fresh vegetable exports by the end of the 1990s.10 The five large multiple retailers in the UK dictated stricter delivery schedules, greater product uniformity and higher levels of packaging—conditions that only larger, more capital intensive organisations were capable of satisfying. Those at the bottom of the supply chain—the 15,000 small producers, and below them the hundreds of thousands of subsistence farmers and landless labourers who provided vegetables to the exporters—received barely subsistence levels of payment for their labour. Capitalist accumulation within the global food industry involved the extension and intensification of class-based exploitation strategies across the globe.

Across the developing world the rapid expansion of cash crops led, for many years, to an over-supply of commodities and wildly fluctuating prices, impoverishing medium and small farmers. Coffee output, for example, increased over the two decades up to 2004 twice as fast as consumption. As a result, overall coffee prices fell by two thirds. Similar developments led to the prices for all agricultural exports remaining low into the late 1990s.11 Agricultural markets in cash crops have been typified by anarchic, uncoordinated boom and bust investment patterns. The beneficiaries have been those firms higher up the supply chain who could begin to dominate commodity markets, determine prices and make big profits. Wal-Mart, Tesco, Nestlé, Monsanto and Starbucks all demonstrate how impoverishment was good for business in the 1990s.

Eventually it was recognised that the IMF’s approach failed to lead to development, and increased rather than decreased developing countries’ dependence upon food aid and borrowing from the World Bank. However, the dominance of big business interests ensured that the blame was placed on continued restrictions within agricultural markets, rather than the liberalisation policies. The outcome was the “Agreement on Agriculture”, which emerged, along with the World Trade Organisation (WTO), out of the Uruguay Round of General Agreement on Tariffs and Trade negotiations in 1992. It sought further to intensify the process of market liberalisation by reducing government subsidies. This was intended to permit “market signals” to be transmitted to producers still more strongly.12

One response to the current crisis in food prices has been to suggest that yet more market liberalisation is the solution. However, it is not the inability of the developing world’s economies to respond to market signals that is the problem; it is the role of the market itself in creating instability.

The capitalist road to greater poverty

As we have seen, trade liberalisation was meant to increase food prices, not decrease them. It also sought to encourage increased investment through increased farm size, as large producers captured the “gains from trade” that comparative advantage was supposed to bring. The liberalisation approach assumes that the numbers of rural poor can only be reduced by transferring most of them out of agriculture and into urban manufacturing. The real goal, then, is the destruction of rural communities and the development of large-scale capitalist agriculture. According to the World Bank’s “Agriculture for Development” report:

Agricultural growth was the precursor to the industrial revolutions that spread across the temperate world from England in the mid-18th century to Japan in the late 19th century. More recently, rapid agricultural growth in China, India and Vietnam was the precursor to the rise of industry.13

Just as the Industrial Revolution depended on people being evicted from agriculture, with the enclosure movement in England and the clearances in Scotland, so the developing world’s landless labourers, subsistence and small farmers are viewed as a hindrance to economic development in the Global South. Estimates by the UN in 2000 suggested that between 20 and 30 million people had been driven from rural areas as a result of agricultural liberalisation policies.14 Development is understood within a narrow capitalist framework of the exploitation of wage labour and the impoverishment of the mass of the population, with a tiny minority, the ruling class within the developing world, benefiting from extreme polarisation of wealth. Such a framework ignores sustainability in terms both of the world’s resources and the impact on the world’s poor.

Even within the logic of capitalism, the primary reason for the failure of developing countries to trade with the developed world does not lie with the structure of agricultural subsidies and support in the developing world. Rather the blame lies with restrictions on exports from the developing world into the developed world. It is in the European Union and the US that subsidies are the most significant. Here subsidies to large-scale producers have existed for over half a century, with direct payments to farmers reaching $235 billion dollars in the developed world by 2003.15 Agriculture became more, not less, protected in the developed world at exactly the time when the developing world was being forced to become more liberalised.

Even where developing countries have maintained their levels of trade, this has not alleviated poverty. From 1990 to 2005, a period in which world trade increased by a notional 200 percent, low income countries were successful at maintaining their share of world exports in agricultural products at 15 percent. Even Africa, a continent whose economic development has fallen behind much of the developing world, maintained its share of world exports at 3.4 percent. But while exports of meat products, horticulture and oil seeds from developing countries have more than trebled, domestic consumption of cereals and staple crops has remained virtually static since the 1980s, and developing country food imports have risen from 7 to 11 percent of world trade as it became the dumping ground for subsided exports from developed countries.16

Food security, the ability of governments to protect domestic production of staple foodstuffs, has been increasingly undermined, leaving the developing world’s poor much more vulnerable to the changes in world food prices that we are now seeing.

The problem of the food market is not the failure of market signals to operate on developing countries but the anarchic results than flow from such signals. Market signals provide information about current prices, but do not provide a mechanism for coordinating or planning for the future. When food prices were low there was little possibility of investment by small and medium farmers, who are the key to food security in most of the developing world. Now, with rising prices, things are no better. The spread of marketisation means that farmers are themselves dependent on buying certain foodstuffs. In addition, they are hit by the rising price of agricultural inputs—fertilisers, pesticides and fuel:

While the price of rice has doubled in recent months, most farmers are benefiting very little—even in Vietnam, the world’s second biggest rice exporter. Their revenue has increased, but so too have their input costs—especially fertiliser, closely linked to the price of energy. Fuel, required for pumping water to their rice paddies and transporting their harvest, is another fast-rising cost. In interviews across Vietnam, rice farmers unanimously reported that their costs have nearly doubled since last year, leaving them without any increase in income, despite the surging rice prices in domestic and global markets.17

Whether food prices are high or low, the world’s hundreds of millions of small farmers are doomed to suffer under the current system.

Speculation and prices

The suffering both of small farmers and of those who depend on the food they produce is being exacerbated by one other factor—speculation.

Commodity markets for food products now operate in exactly the same way as other markets. Each commodity group has exchanges for futures contracts, hedging and price guarantees. Market intermediaries, large-scale buying organisations and dominant firms utilise forecasts to minimise their exposure to risk, and this is supposed to provide a mechanism for stabilising prices. However, commodity exchanges do something else as well. They permit speculation rather than productive investment. Speculation is the ability to recognise market trends and use short-term buying and selling to generate high profits in specific markets at particular points in time. Such speculative investment can have profoundly destabilising effects on markets. The collapse of the dotcom bubble, and then the housing and banking bubbles have left those wishing to invest in short-term markets with fewer opportunities for speculative investments. They have been turning their attention to commodities markets, including food, buying up future supplies on the assumption that their prices will rise and, by doing so, pushing those prices up even more. As the Financial Times reports:

Institutional and retail investment in commodities has shot up, lured by research that shows commodities can diversify a portfolio, and by “performance-chasing”; money pours into sectors that have made money. According to Philip Verleger, a consultant, the amount invested that way has multiplied by five, to about $250 billion, in just three years.18

The volume of speculation has been rising steeply. Since 2003, says Morgan Stanley, open interest in corn futures has risen from 500,000 contracts to almost 2.5 million… More speculative money will go in, and will play a larger role in the rise itself. And, of course, more people in the poorest countries will starve.19

The IMF claims that, while speculative investment has not caused prices to rise, once they do, speculative investment rapidly flows into the market.20 The recent nature of this speculation can be seen in Table 1.

Table 1: Selected commodity prices (2005=100)

Source: IMF

| Commodity group | 1998 | 2005 | March 2008 (estimated) |

|---|---|---|---|

| All primary commodities | 48 | 100 | 181 |

| Oil | 25 | 100 | 191 |

| Food | 92 | 100 | 170 |

While average prices for all primary commodities more than doubled between 1998 and 2005, food commodities only rose marginally, from 92.0 to 100, but since 2005 food prices have risen much more rapidly than previously. However, it is only by understanding the more deep-rooted changes that have occurred in world food systems that we can understand why speculation has had such a devastating impact.

Destructive scenarios

If the cause of the current food crisis is the anarchy brought about by market mechanisms, what are the long-term prospects?

There are two widely held views. The first is that the present upsurge in food prices is similar to the last great upsurge in 1972-3. On that occasion there was a sudden increase in demand for grain imports due to a short-lived world boom, which coincided with the sudden entry of the USSR into the world market for grain following problems with its own harvests. The price upsurge contributed to inflation worldwide, but subsided by the late 1970s, with food prices then falling over the long term compared to other prices. On this view, the present price surge may well be disastrous and lead to up to 100 million people starving due to the inability of world agencies to take counter-measures. But the disaster would only last a few years.

The second view is much more catastrophist.21 It holds that the present crisis signals the exhaustion of the new ways of increasing crop yields that overcame the food price crisis of the 1970s. These ways, usually referred to as the Green Revolution, were based on the use of new, more productive grain varieties, combined with very big increases in fertiliser and water pump use. Today China uses 40 million tons of fertiliser a year, the US 19 million tons and India 16 million tons. As a result world grain production in 2004, at about two billion tonnes, was three times higher than in 1950s, with worldwide average grain consumption per head up 24 percent, despite population growth. This has banished for more than a generation the spectre of famine and death from starvation (as opposed to widespread malnutrition) from the two Asian giants—India and China.

But the Green Revolution has now reached a “plateau”, according to the 2008 report from the International Assessment of Agricultural Knowledge, Science and Technology for Development (IAASTD).22 World acreage devoted to food is not growing and grain output is only just keeping abreast with population growth in Asia, while the situation in Africa is even worse.

The World Bank’s latest “World Development Report” admits that conventional strategies of “development” are failing in this respect:

Many agriculture-based countries still display anaemic per capita agricultural growth and little structural transformation… The same applies to vast areas within countries of all types. Rapid population growth, declining farm size, falling soil fertility, and missed opportunities for income diversification and migration create distress as the powers of agriculture for development remain low. Policies that excessively tax agriculture and underinvest in agriculture are to blame, reflecting a political economy in which urban interests have the upper hand. Compared with successful transforming countries when they still had a high share of agriculture in GDP, the agriculture based countries have very low public spending in agriculture as a share of their agricultural GDP (4 percent in the agriculture-based countries in 2004 compared with 10 percent in 1980 in the transforming countries).23

The chances of the catastrophist scenario materialising could be increased enormously by climate change, which is likely to hit food production in the most populated parts of the world. Modelling climate change is fraught with problems, and linking this to agriculture, with assumptions regarding future land use, output growth, consumption patterns and population change, is still more problematic. Nevertheless, modelling suggests that the Intergovernmental Panel on Climate Change’s estimates of a 4ºC rise could lead to a marginal fall in overall agricultural yields with a dramatic change in the distribution of this output as desertification affects regions closer to the equator. One study suggests that without climate change output of cereal production would double by 2080. With climate change this projected output would be reduced by just 0.6-0.9 percent worldwide. But while in this scenario output in much of the developed world would rise, output in Africa, East Asia and South Asia would fall, by perhaps 20 percent in the case of South Asia.24 It is possible to dispute the accuracy of the particular models used in studies, but in all likelihood the costs of climate change will fall disproportionately on the poorest of the world’s population.25

Added to this problem is the diversion of land use for the production of biofuel. Nothing highlights the anarchy of market mechanisms more than the movement into biofuels. Across the globe from Brazil to Indonesia rainforests have been destroyed to make way for plantations. Rainforests are burned and the soil depleted in order to produce an oil to reduce carbon use. Similarly, in the US government support for ethanol as a biofuel has ensured major subsidies to the developing industry and with them the shift of maize from food into ethanol production.

Biofuels have been promoted as a way of warding off climate change. Achieving food sustainability requires a recognition that biofuels are not a sufficient solution to climate change. Climate change cannot be addressed simply by the replacement of one form of carbon use with another, but instead by solutions which remove carbon use from society altogether. The motivation of the Bush administration in the US has not been climate change, but to protect energy supplies for US capitalism. Biofuel production is estimated to be profitable against oil-based fuel production once the oil price exceeds $60 per barrel. There is growing belief in capitalist circles that oil production worldwide has peaked and that the price is going to remain above this level. This is leading to an even greater proportion of the US maize crop being devoted to biofuel production this year than last. Overall the use of crops for biofuels is estimated to be responsible for about 30 percent of the increase in grain prices over the past five years.26

The high oil price then threatens a double blow to food output and prices. On the one hand, it raises the cost of fuel and fertilisers used in agriculture, in ways which make it much more difficult to increase crop yields using the methods of the past four decades. On the other hand, it diverts land from food to biofuel production. Both shifts aggravate the threat to future food supplies from climate change. Such is the terrible price humanity risks paying because of capitalism’s addiction to burning carbon—even though fertiliser production itself only uses about 1 percent of global energy.27

The IMF suggest worldwide demand for food may triple by 2080, outstripping supply and creating chronic shortages. Although they do not say it, that would be a catastrophic outcome and an indictment of capitalist accumulation strategies as a means of feeding humanity. By contrast, Tubiello and Fischer suggest that if climate change can be ameliorated, then, even in the “worst case” scenario of a doubling of population pressures on food sources, it would still be possible to provide sufficient food for a population of 12 billion people by 2080.28

What seems clear is that the current reliance on large-scale agriculture, the use of monocultures, oil based fertilisers and intensive use of fresh water to expand food output is increasingly unsustainable. The World Bank and IAASTD reports both half accept this. They point to the need for more agricultural investment directed towards the hundreds of millions of small labour-intensive farms, paying attention to water management, organic complements to mineral fertilisers and preventing further degradation of the soil. And they bemoan the failure of governments to direct funds in this direction. Yet their commitment to capitalism means they turn their back on their own insights, and continue to stress high value crops and the growth of large-scale capitalist farming at the expense of the rural poor and the provision of basic foodstuffs.

Under the current model of capitalist food production, the ability to supply enough food to match people’s demand is increasingly under threat. If this scenario develops it will not be due to a Malthusian excess of population but to a failure of the capitalist mode of production. Capitalism has proven destructive to food production, giving rise to very specific destructive and unsustainable forms of economic development.

There is no doubt that it lies behind the current price upsurge, with the risk of tens of millions starving in a particularly gruesome version of the slump-boom cycle. And there is a strong likelihood that it is producing a long-term threat to world food security that will persist even if the current crisis eventually passes. The ability to develop a sustainable food production system requires democratic control by the world’s population.

Notes

1: Alan Beattie, “Governments Can No Longer Ignore The Cries Of The Hungry”, Financial Times, 5 April 2008.

2: “Food Outlook”, FAO, May 2008, www.fao.org/docrep/010/ai466e/ai466e00.htm

3: See Walker, 2006, for a detailed account of the connections between energy and fertiliser costs.

4: “Financial System Faces Commodity-led Crisis”, Financial Times, 5 March 2008.

5: IMF, 2006, chapter five, box 5.2.

6: World Bank, 2007, p11.

7: Madeley, 2000, p58.

8: Hellin and Higman, 2003, p36.

9: Stiglitz, 2002, pxii.

10: Dolan and Humprey, 2004.

11: Hellin and Higman, 2003, pp36-37.

12: Morelli, 2003.

13: World Bank, 2007.

14: Madeley, 2000, p75.

15: Nash, 2004, p34.

16: World Bank, 2007, figure six.

17: “Vietnam’s Farmers Face Paradox Of The Paddy”, Globe and Mail, 1 May 2008. See also “Rice Prices Fail To Benefit Asian farmers”, Financial Times, 29 April 2008.

18: “Classic Films Shed Light On Commodities Boom”, Financial Times, 9 May 2008.

19: “Speculators Feast On Soaring Commodities”, Financial Times, 12 May 2008.

20: It should be added that the IMF’s research examined historical moves in prices, not those that have taken place so rapidly over the past year, so even their limited rejection of speculation may no longer hold.

21: For an extreme version of this view, see Pfeiffer, 2004, which was circulated by the student campaign network People and Planet among others.

22: Feldman, Nathan, Raina and Yang, 2008.

23: World Bank, 2007, p7.

24: Tubiello and Fischer, 2007.

25: This conclusion is confirmed by the IMF’s own research. See Cline, 2008.

26: Rosegrant, 2008.

27: Schrock, 2006.

28: Cline, 2008; Tubiello and Fischer, 2007.

References

Cline, William R, 2008, “Global Warming and Agriculture”, Finance and Development, volume 45, number 1, www.imf.org/external/pubs/ft/fandd/2008/03/cline.htm

Dolan, Catherine, and John Humprey, 2004, “Changing Governance Patterns in the Trade in Fresh Vegetables between Africa and the United Kingdom”, Environment and Planning A, volume 36, number 3.

Feldman, Shelley, Dev Nathan, Rajeswari Raina and Hong Yang, 2008, “International Assessment of Agricultural Knowledge, Science and Technology for Development. East and South Asia and Pacific: Summary for Decision Makers”, IAASTD, www.agassessment.org/docs/ESAP_SDM_220408_Final.pdf

Hellin, John, and Sophie Higman, 2003, Feeding the Market: South American Farmers, Trade and Globalisation (ITDG).

IMF, 2006, “World Economic Outlook” (September 2006), www.imf.org/external/pubs/ft/weo/2006/02/

Madeley John, 2000, Hungry for Trade (Zed).

Morelli, Carlo, 2003, “The Politics of Food”, International Socialism 101 (winter 2003),

www.isj.org.uk/index.php4?id=36

Nash, John, 2004, “Agricultural Trade: Reaping a Rich Harvest from Doha”, Finance and Development, volume 41, number 4, www.imf.org/external/pubs/ft/fandd/2004/12/pdf/picture.pdf

Pfeiffer, Dale Allen, 2004, “Eating fossil fuels”, From the Wilderness, www.fromthewilderness.com/free/ww3/100303_eating_oil.html

Rosegrant, Mark W, 2008, “Biofuels and Grain Prices: Impacts and Policy Responses”, International Food Policy Research Institute, Testimony for the US Senate Committee on Homeland Security and Governmental Affairs, 7 May 2008, www.ifpri.org/pubs/testimony/rosegrant20080507.pdf

Schrock, Richard, 2006, “Nitrogen Fix”, MIT Technology Review (May 2006), http://www.technologyreview.com/article/16822/

Stiglitz, Joseph, 2002, Globalisation and its Discontents (Penguin).

Tubiello, Francesco N, and Günther Fischer, 2007, “Reducing Climate Change Impacts on Agriculture: Global and Regional Effects of Mitigation, 2000-2080”, Technological Forecasting and Social Change 74, http://pubs.giss.nasa.gov/docs/2007/2007_Tubiello_Fischer.pdf

Walker, David, 2006, “Energy and Fertiliser Costs”, MI Prospects, volume 8, number 19,

www.hgca.com/imprima/miprospects/vol08Issue19/minisite/Vol08Issue19.pdf

World Bank, 2007, “World Development Report 2008: Agriculture for Development”, http://go.worldbank.org/ZJIAOSUFU0